Introduction to UNH Stock

UnitedHealth Group Incorporated (UNH) is a key player in the healthcare sector, providing a diverse range of services including health insurance and health management. The stock’s performance is critical for investors and analysts alike, reflecting not just the company’s success but also broader trends in the healthcare industry. As of late 2023, UNH stock has drawn significant attention due to its resilience during fluctuating market conditions and its strategic efforts towards expanding healthcare access.

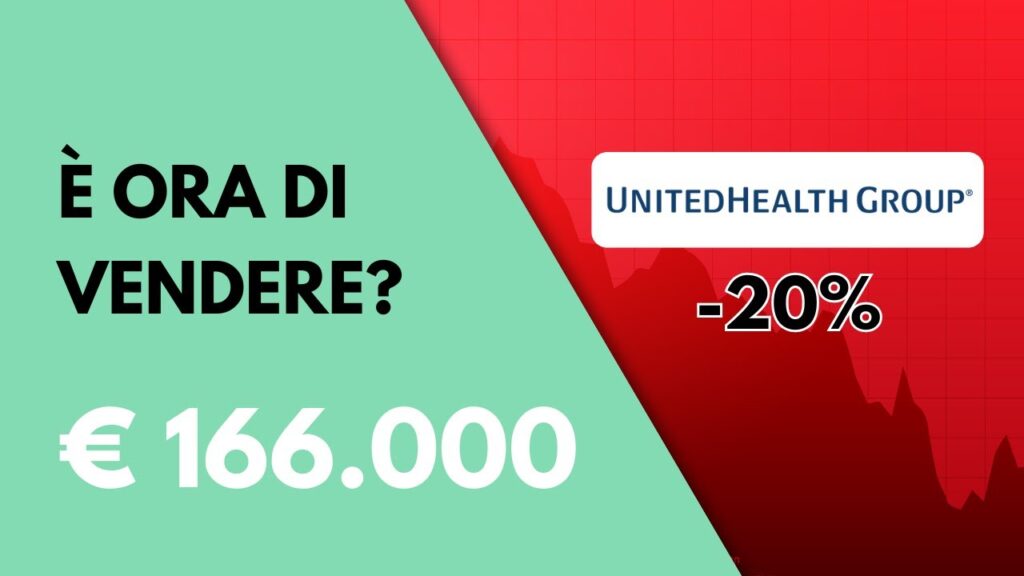

Current Market Performance

As of October 2023, UNH stock has shown notable stability despite market volatility. The stock is currently trading at approximately $600 per share, representing a year-to-date increase of around 12%. This increase can be attributed to several key factors, including the successful navigation of post-pandemic healthcare challenges and the company’s innovative approaches to diversifying its services.

Recent Innovations and Strategies

UnitedHealth has made headlines recently with its new technology investments aimed at streamlining patient care and increasing efficiency. Initiatives such as telehealth expansions and artificial intelligence applications in service deliverance have positioned UNH as a leader in the market. Furthermore, these strategies have attracted a larger patient demographic, which in turn supports their stock performance. The company’s recent acquisition of technology firms specializing in health data management aims to bolster its offerings and improve overall patient outcomes.

Analyst Opinions and Future Outlook

Market analysts maintain a cautiously optimistic view of UNH stock. Many recommend a ‘buy’ rating, citing the company’s solid fundamentals, historical performance, and growth potential in the healthcare sector. Analysts expect a notable increase in earnings in upcoming quarters, largely driven by an aging population that requires increased healthcare services and management. Additionally, the ongoing policy reforms aimed at making healthcare more accessible are predicted to benefit UnitedHealth’s business model significantly.

Conclusion

In conclusion, UNH stock stands as a vital consideration for investors interested in the healthcare sector. Its consistent performance, innovative strategies, and market adaptability signal a promising future. As the industry undergoes transformational changes, UnitedHealth Group is well-positioned to leverage growth opportunities. Investors should continue to monitor UNH stock, as it not only reflects the company’s health but also serves as an indicator of the overall healthcare industry’s trajectory in the coming years.