Introduction

Visa Inc. (NYSE: V), a global leader in digital payments, has seen its stock become a focal point for investors in recent months. As consumer behavior shifts towards cashless transactions and digital commerce, understanding Visa’s stock performance is pivotal for anyone interested in the financial markets. The company’s ability to adapt to evolving market conditions makes Visa stock particularly relevant for both seasoned and novice investors.

Current Performance

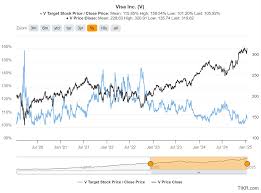

As of mid-October 2023, Visa’s stock price has experienced fluctuations due to various external factors, including economic conditions and geopolitical tensions. According to recent reports, Visa’s share price is approximately $220, up from around $200 earlier this year. The company’s financial results for Q3 2023, which revealed a revenue increase of 11% year-on-year, played a significant role in boosting investor confidence. The increase can be attributed to a rise in consumer spending and the continued adoption of the digital payment ecosystem.

Market Trends Affecting Visa Stock

Several trends are currently influencing Visa’s stock performance:

- Growth of E-commerce: With more consumers turning to online shopping, payment processing volumes have surged. Visa reported a record number of transactions in their last earnings call, highlighting the strength of their payment network.

- Innovations in Payment Technology: The rise of contactless payments and mobile wallets has positioned Visa at the forefront of payment innovations. This expansion in offerings is expected to support sustained growth in transaction volume.

- Regulatory Changes: Regulatory scrutiny on transaction fees and data privacy is ongoing, and any adverse regulations could impact Visa’s profitability. Recent conversations in Congress about credit card processing fees could be a double-edged sword for the company.

Future Projections

Analysts have mixed projections for Visa stock going into 2024, with some anticipating continued growth due to robust consumer spending and ongoing technological advancements in the payment sector. Others caution that economic uncertainties, including inflation and interest rate hikes, may pose risks to growth. However, Visa’s strong market position, coupled with strategic investments in technology and partnerships, positions the company well to weather potential downturns.

Conclusion

Visa stock remains a compelling consideration for investors looking to capitalize on the growth of the digital payments industry. With robust financial performance and positive growth prospects amplified by technological innovations, Visa continues to hold significant potential. However, potential investors should remain aware of the regulatory environment and economic factors that may affect its performance. Overall, Visa’s adaptability and market leadership suggest that its stock could be a strong investment in the years to come.