Introduction

Uber Technologies, Inc., a revolutionary force in the ridesharing and food delivery markets, has become a focal point for investors and market analysts alike. The performance of Uber stock is not only indicative of the company’s operational success but also reflects broader trends in technology and the gig economy. As the stock market evolves, understanding the dynamics of Uber’s market value is crucial for current and potential investors.

Recent Performance and Market Trends

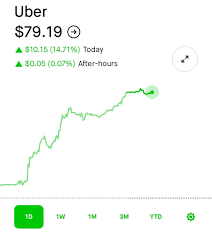

As of October 2023, Uber’s stock has experienced notable fluctuations, influenced by various factors such as economic conditions, consumer behavior shifts, and regulatory changes. Over the past year, the stock has seen a rise of approximately 25%, reflecting growing investor confidence as the company expands its services and achieves profitability.

Uber’s recent earnings report highlighted a surge in revenue, driven by increased demand for both ridesharing and their delivery service, Uber Eats. With the global pandemic leading to an uptick in food delivery services, Uber has leveraged this trend effectively. Analysts also noted a significant rebound in ridesharing demand as travel restrictions were lifted, leading to improved operational metrics.

Economic Factors Influencing Uber Stock

The broader economic landscape plays a vital role in Uber’s stock performance. Inflation, interest rates, and changes in consumer spending all impact the company’s financial outcomes. Recent monetary policy adjustments by the Bank of Canada and other central banks worldwide have created a cautious atmosphere, prompting investors to closely monitor the tech sector’s response to tightening economic conditions.

Future Forecasts

Looking ahead, market analysts project mixed forecasts for Uber stock. While some experts predict continued growth due to the company’s adaptability and ability to innovate, others express concerns about mounting competition in the ridesharing space and potential regulatory hurdles that could affect profitability.

Moreover, as Uber explores diversification opportunities, such as electric vehicle adoption and autonomous vehicle technology, its long-term viability may hinge on successfully navigating these innovations while maintaining market leadership.

Conclusion

As Uber Technologies continues to play a pivotal role in transforming transportation and delivery services, investors and market observers are urged to remain informed about the fluctuating dynamics of Uber stock. Understanding market conditions and Uber’s operational strategies is essential for forecasting its trajectory in the coming years. Whether viewed as a growth opportunity or a speculative asset, Uber remains a significant player in the global economy, influencing not only its sector but also wider market sentiments.