Introduction

The stock of Taiwan Semiconductor Manufacturing Company (TSMC), traded as TSM on the New York Stock Exchange, is a crucial element in the global semiconductor ecosystem. As the largest dedicated independent semiconductor foundry in the world, TSMC plays a pivotal role in the production of chips for various technology sectors. Its stock is closely monitored by investors looking to understand both the semiconductor market and broader economic trends, especially in light of ongoing developments in technology and international trade.

Recent Performance

As of October 2023, TSM stock has demonstrated resilience despite fluctuations in the global market. After hitting a 12-month high in late June, the stock faced a moderate downturn in July and August, primarily due to supply chain disruptions and economic uncertainty. Analysts, however, have noted that TSMC’s robust demand for advanced chips, particularly in automotive and high-performance computing sectors, positions the company favorably for growth.

Key Drivers

Several factors are contributing to TSM’s current market performance:

- Technological Advancements: TSMC is leading the industry with its 5nm and 3nm process technologies, making it the go-to supplier for major clients such as Apple, Nvidia, and AMD.

- Global Demand Surge: The demand for semiconductors has surged due to trends like artificial intelligence, the Internet of Things, and the increased production of electric vehicles.

- Strategic Partnerships: TSMC has entered various agreements to expand its production capabilities, including a recent joint venture with Sony to build a semiconductor plant in Japan.

Market Outlook

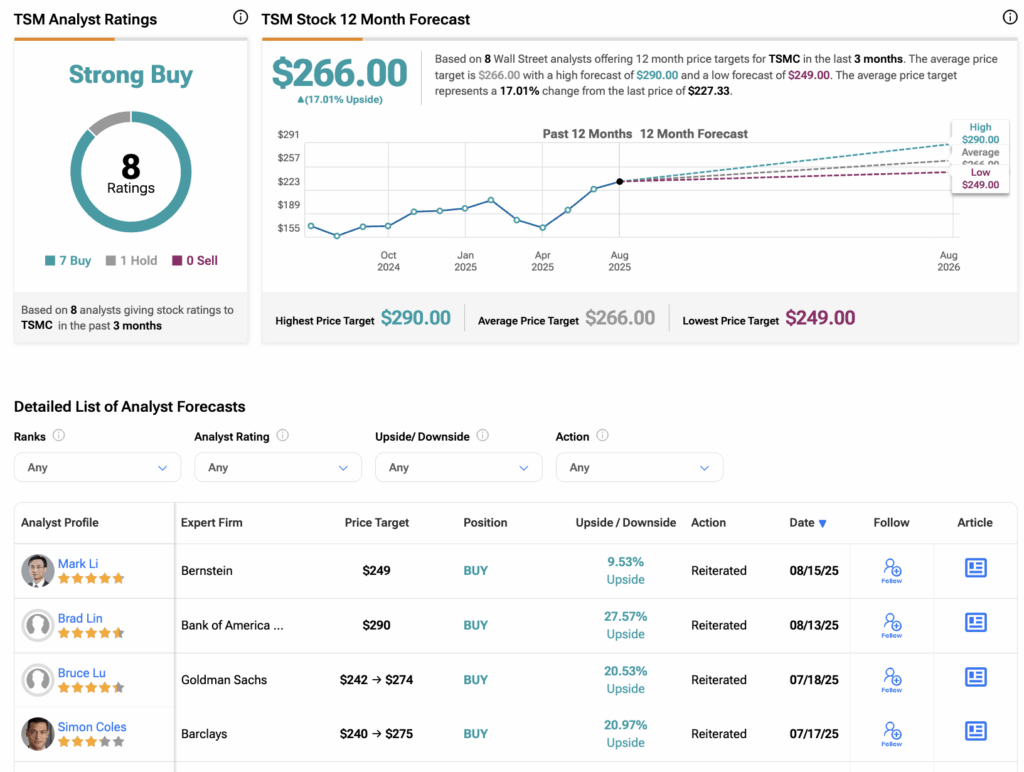

Looking ahead, analysts generally maintain a positive outlook on TSM stock. According to recent reports, while the industry may experience a slowdown due to potential global economic impacts, TSMC is expected to outperform its competitors. The company’s strong technological edge and partnership strategies are likely to mitigate risks associated with supply chain issues and geopolitical tensions. Forecasts suggest that the stock might see a growth resurgence toward the end of 2023, particularly as consumer electronics demand returns following seasonal shopping trends.

Conclusion

For investors considering TSM stock, it is essential to keep a close eye on the semiconductor market’s volatility as well as TSMC’s innovative projects and partnerships. The company’s ability to stay ahead of technological advancements will be paramount in ensuring its market leadership. As TSMC navigates both challenges and opportunities in the coming months, its stock remains a critical indicator of broader trends in technology and manufacturing sectors.