Introduction

The Tax-Free Savings Account (TFSA) is a crucial financial tool for Canadians, allowing them to save and invest money without incurring tax on interest, dividends, or capital gains. The contribution limit for the TFSA can vary each year, influencing how much Canadians can contribute without incurring penalties. Understanding the 2026 TFSA contribution limit is essential for effective financial planning and maximizing savings.

Current Contribution Limits

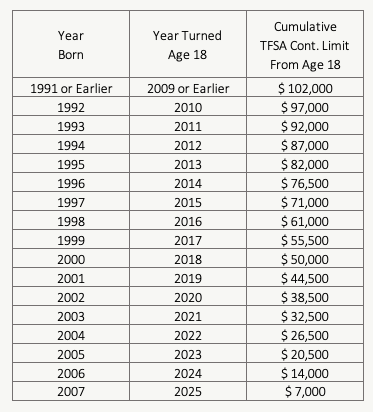

As of 2023, the annual contribution limit for the TFSA is set at $6,500, which has been consistent since 2023, following a previous increase from $6,000 in 2022. Typically, these limits are adjusted for inflation based on Canada’s Consumer Price Index (CPI). The government reviews and announces these limits every year to ensure they remain aligned with the evolving economic conditions.

Forecast for 2026

While the exact TFSA contribution limit for 2026 remains unconfirmed until its official announcement, financial analysts predict that it could reach between $7,000 to $7,500, assuming a continued trend of gradual increases based on inflation. A TFSA contribution limit increase would enable Canadians to save more and take advantage of tax-free growth in their investments. For anyone planning their savings strategy, it is wise to include these estimates in their financial plans.

Implications of Contribution Limit Changes

Increased contribution limits can significantly impact medium- to long-term savings goals. For younger Canadians especially, being able to contribute more to a TFSA could facilitate larger savings for milestones such as buying a home, funding education, or retirement planning. On the other hand, individuals who may have already maxed out their contributions may face concerns about the administrative aspect if limits increase, as keeping track of contributions becomes critical to avoid penalties.

Conclusion

In summary, staying informed about the TFSA contribution limit for 2026 is vital for all Canadians aiming to optimize their savings and investment strategies. As we move closer to 2026, it will be essential for individuals to watch for government announcements regarding the new limits and incorporate this information into their financial planning. By actively managing contributions, Canadians can ensure they take full advantage of the tax benefits that the TFSA offers, and maximize the potential for long-term financial growth.