Introduction

The S&P 500 index, a pivotal benchmark for the US stock market, reflects the performance of 500 large companies listed on stock exchanges in the United States. This index is crucial for investors as it provides insights into the overall health of the economy and stock market trends. Recent market volatility and changes in interest rates have heightened the importance of monitoring the S&P 500, as it influences investment strategies and economic forecasts.

Recent Performance and Changes

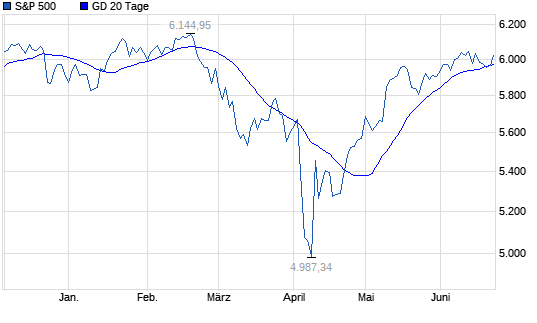

As of October 2023, the S&P 500 has seen a fluctuating trajectory, closing at approximately 4,350 points. Despite rising interest rate fears and inflation concerns, the index has managed to retain relatively strong performance, buoyed by robust earnings reports from the technology and healthcare sectors. Notable companies such as Apple, Microsoft, and Amazon have significantly contributed to this resilience, with many reporting better-than-expected quarterly earnings.

During the last quarter, the index experienced a notable rise of 5%, indicating a cautious optimism among investors. However, this resurgence was met with renewed concerns regarding the Federal Reserve’s monetary policy and its implications for corporate profits. Analysts project that, going forward, the S&P 500 may face additional volatility as markets respond to shifts in economic policy and global events.

Market Drivers and Investor Sentiment

Several factors currently drive the dynamics of the S&P 500. The Federal Reserve’s approach to combating inflation, which has included raising interest rates, has prompted investors to reassess their portfolios. Moreover, geopolitical tensions, particularly in Europe and Asia, could lead to slower economic growth, impacting stock performance. Investor sentiment remains cautious, with many opting for value stocks and inflation-hedged investments, reflecting a more defensive strategy in uncertain times.

Conclusion and Future Outlook

In conclusion, the S&P 500 continues to be a critical indicator of the health of the U.S. economy and stock market, offering insights that are relevant for both individual and institutional investors. As we head into the final months of 2023, projections suggest that the index could experience further fluctuations and potentially test its historical highs or lows. Investors are advised to stay informed of economic indicators and policy changes as these will greatly influence the S&P 500’s trajectory over the coming months. The ongoing developments reinforce the significance of careful market analysis and adaptive investment strategies to navigate the complexities of today’s economic landscape.