Introduction

The Federal Reserve, often referred to as the Fed, holds a pivotal role in the economic system of the United States. Established in 1913, it serves as the central bank of the nation, responsible for implementing monetary policy, supervising and regulating banks, and maintaining financial stability. As inflation and economic fluctuations have been markedly influential in recent years, the Fed’s actions have become increasingly relevant and scrutinized by both economists and the public.

Recent Developments

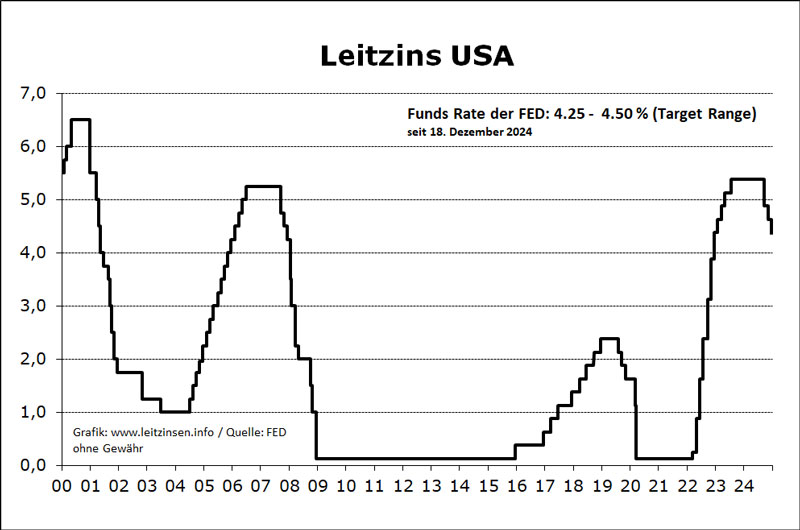

In response to rising inflation rates, which hit a four-decade high in mid-2022, the Federal Reserve has embarked on a series of aggressive interest rate hikes, the most recent of which occurred in September 2023. This was the Fed’s fifth consecutive rate increase in 2023, with the target range for the federal funds rate now standing between 5.25% and 5.50%. These measures aim to curb inflationary pressure, which has been exacerbated by supply chain disruptions and post-pandemic consumer behavior.

Moreover, the Fed has indicated that it intends to closely monitor inflation data and economic indicators to determine future rate adjustments, suggesting that the current tightening cycle might persist until there is a significant decrease in inflation rates. This careful balancing act is crucial, as overly aggressive rate hikes could risk triggering a recession, while insufficient measures might allow inflation to spiral further out of control.

Impact on the Economy and Markets

As the Fed continues to make policy changes, its impact reverberates throughout various sectors of the economy. Higher interest rates often lead to increased borrowing costs for consumers and businesses, which can slow down spending and investment. This has already been reflected in the housing market, where mortgage rates have surged, causing a decline in home sales and shifts in housing affordability.

In the financial markets, stock prices have shown volatility in response to Fed announcements, as investors reassess their expectations for growth and corporate profits. During the recent Fed meeting, market analysts noted a cautious sentiment, with many anticipating a possible recession in the near future if economic conditions do not improve.

Conclusion

The Federal Reserve remains a cornerstone of the U.S. financial system, wielding considerable influence over economic conditions through its monetary policy. As inflation persists and economic uncertainties loom, the Fed’s policy decisions will continue to be closely monitored by all aspects of the economy. For consumers and investors alike, understanding the Fed’s role and potential future actions is essential for navigating the financial landscape in the coming months.