Introduction

The Nasdaq Composite Index is a crucial market index that reflects the performance of over 3,000 stocks listed on the Nasdaq stock exchange. Known for its heavy weighting in technology-related companies, the Nasdaq Composite has become a barometer of investor sentiment and market trends, particularly in the tech sector. Understanding its movements can provide insights into broader economic conditions and stock market behavior.

Recent Performance and Key Developments

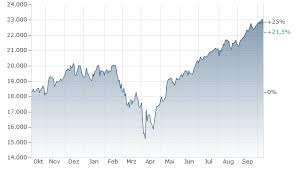

As of October 2023, the Nasdaq Composite has seen significant volatility, largely attributed to changes in interest rates, inflation concerns, and shifts in consumer behavior post-pandemic. Recently, the index experienced a notable rally, driven by strong earnings reports from major tech firms such as Apple, Microsoft, and NVIDIA. This resurgence is significant as it signals the resilience of the tech sector, even in a fluctuating economic landscape.

Data from market analysts indicate that the Nasdaq Composite rose by 12% in the third quarter of 2023, outperforming other major indices like the S&P 500 and Dow Jones Industrial Average. Analysts suggest that this growth is partly due to increased investments in artificial intelligence and cloud computing, which have become focal points for innovation and growth within the technology industry.

Factors Influencing the Nasdaq Composite

Several factors can impact the Nasdaq Composite’s performance. Interest rates play a critical role; as the Federal Reserve adjusts rates to combat inflation, investor sentiment can shift rapidly. High-interest rates generally lead to increased borrowing costs, which can pressure growth stocks, especially in technology.

Additionally, economic indicators such as unemployment rates, consumer spending, and geopolitical tensions can have a profound effect on market performance. For example, recent job growth reports have fueled optimism, resulting in investors favoring tech stocks, leading to the Nasdaq’s recent gains.

Conclusion

The Nasdaq Composite Index remains a vital indicator of market performance, especially within the technology sector. As investors continue to navigate through economic uncertainties, the index’s movements could offer vital insights into future market trends. Looking ahead, analysts expect continued volatility but project long-term growth in technology as innovations emerge. For readers and investors, monitoring the Nasdaq Composite will be crucial in understanding both the current market landscape and the future potential of tech-based investments.