Introduction

The recent Federal Reserve rate cut has significant implications for both the economy and consumers. As central banks worldwide navigate complex economic conditions, changes in interest rates can influence consumer borrowing, spending, and overall economic growth. Understanding the Fed’s decision is crucial in assessing its potential effects on financial markets and daily life.

What Happened?

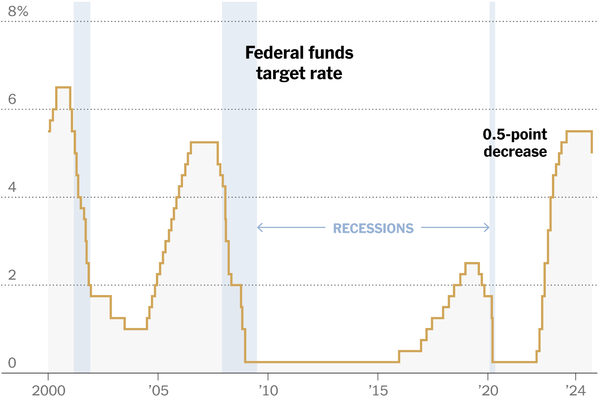

On October 3, 2023, the Federal Reserve announced a cut to the federal funds rate by 0.25%, lowering it to a range of 4.50% to 4.75%. This decision came as a response to various economic indicators, including sluggish consumer spending and decelerating inflation rates. The Fed aims to stimulate economic growth by making borrowing cheaper for consumers and businesses, thus fostering an environment conducive to spending and investment.

Impact on Consumers and Businesses

The most immediate effect of the rate cut will be seen in loan interest rates, such as mortgages, personal loans, and business loans. With lower borrowing costs, individuals are likely to consider purchasing homes or cars, while businesses may feel encouraged to invest in expansion. Analysts predict a potential uptick in the housing market as prospective buyers take advantage of the decreasing mortgage rates, which historically tend to follow the Fed’s adjustments.

Market Reactions

Following the announcement, stock markets experienced a surge, reflecting investor optimism about increased consumer spending. However, financial analysts warn that while the cut may provide short-term relief, challenges in the finance landscape could be hard to overcome in the long run. Concerns about ongoing inflation and geopolitical instability still loom, complicating the Fed’s efforts to motivate sustainable economic growth.

Conclusion

The recent Fed rate cut is a pivotal development in the economic landscape of the United States and beyond. It signifies an attempt to stimulate growth amidst uncertainty but comes with risks that may impact its effectiveness. As consumers, businesses, and investors adjust to the new rates, the broader implications of this cut will continue to unfold, playing a crucial role in the economic narrative of the upcoming year. Monitoring these changes will be essential for individuals and organizations aiming to make informed financial decisions.