Introduction

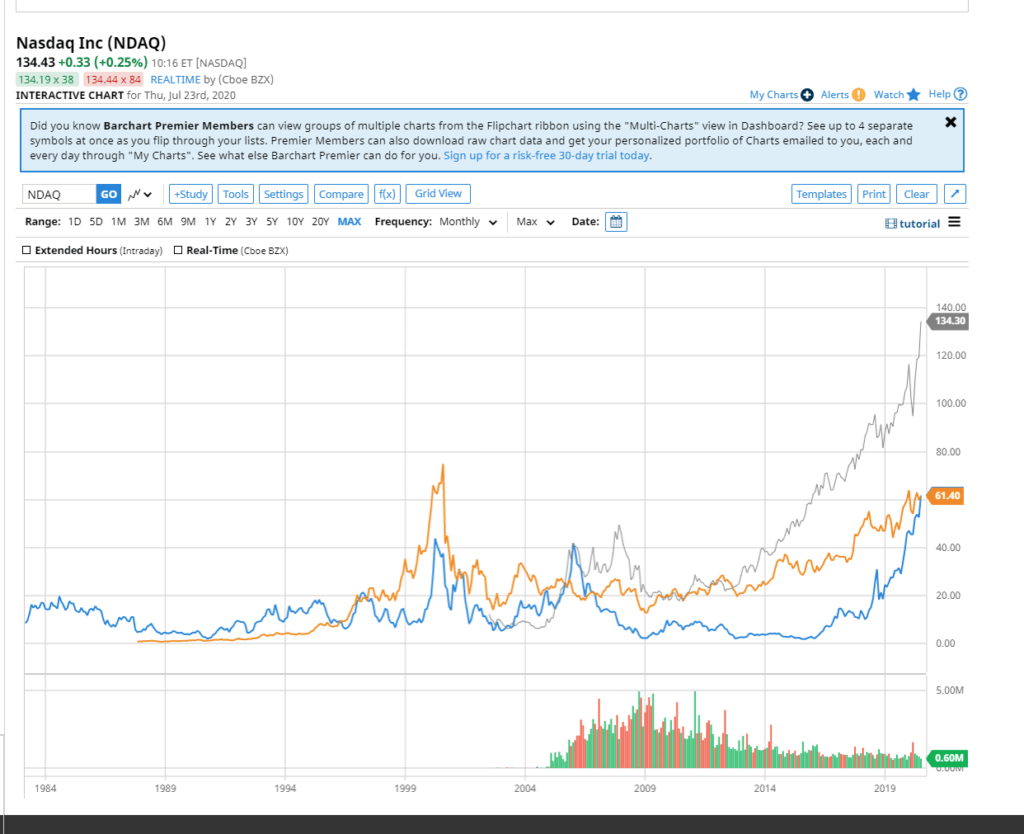

The stock of Advanced Micro Devices, Inc. (AMD) has become a focal point for investors amidst a rapidly changing tech landscape. AMD, known for its high-performance computing and graphics solutions, has shown remarkable resilience and growth in recent years. The company’s stock performance not only reflects its technological advancements but also indicates broader trends in the semiconductor industry. As AMD continues to innovate, understanding the key factors influencing its stock price is crucial for investors looking to make informed decisions.

Current Performance and Market Trends

As of October 2023, AMD stock has been trading in a volatile range, reflecting both market challenges and opportunities. The company recently reported its quarterly earnings, showcasing revenue growth driven by strong demand for its Ryzen and EPYC processors. Analysts noted that the company’s recent partnerships with major cloud service providers have bolstered its market position, contributing to a positive outlook. As of October 20, 2023, AMD shares are priced around $90, maintaining a market cap of approximately $100 billion.

Investors have reacted positively to AMD’s focus on artificial intelligence (AI) and machine learning technologies. The company announced new product lines integrating AI capabilities, which many analysts believe will drive future growth. Furthermore, with the resurgence of gaming and the increasing demand for powerful graphics solutions, AMD’s Radeon GPUs continue to gain traction in the market.

Challenges Ahead

Despite its strong performance, AMD faces significant challenges. The semiconductor industry is highly competitive, with rivals like NVIDIA and Intel investing heavily in next-generation technologies. Supply chain constraints and fluctuating raw material costs also pose risks that could impact profitability in the coming quarters. Additionally, broader economic conditions and interest rate fluctuations could affect investor sentiment towards tech stocks, including AMD.

Conclusion

In conclusion, AMD stock remains a compelling option for investors interested in tech and semiconductor sectors due to its ongoing innovations and market strategies. While the stock has shown resilience, potential investors should remain vigilant regarding market pressures and industry competition. As the company continues to evolve and adapt to market demands, analysts predict that AMD could emerge stronger, solidifying its role as a leader in the technology landscape. Keeping an eye on AMD’s developments and industry trends will be key for current and prospective investors in navigating the stock’s future trajectory.