Introduction

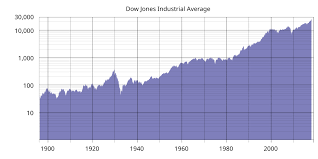

The Dow Jones Industrial Average (DJIA) is one of the most closely watched stock market indices in the world. It represents 30 major publicly traded companies in the United States and serves as a barometer for the overall health of the American economy. Recent fluctuations have heightened interest in the index, making it an essential topic for investors and analysts alike, particularly in the wake of ongoing economic challenges and uncertainties.

Recent Trends and Developments

As of October 2023, the DJIA has shown considerable volatility. In the past few months, it has navigated through hurdles such as inflationary pressures, fluctuating interest rates, and geopolitical tensions. In September 2023, the DJIA reached an all-time high, surpassing 36,000 points for the first time, mainly driven by strong earnings reports from key sectors like technology and healthcare.

However, following this peak, analysts observed a significant correction as concerns grew over the Federal Reserve’s potential interest rate hikes aimed at curbing inflation, which has remained stubbornly high around 4.5%. This resulted in a mixed performance throughout October, with the DJIA experiencing sharp declines interspersed with brief recoveries. Adjustments to monetary policy and global economic indicators continue to influence investor sentiment and stock selections.

Key Influencing Factors

Among the companies significantly impacting the DJIA is Apple Inc., which has seen fluctuating stock prices in response to the launch of its latest products and supply chain challenges. Furthermore, companies in the financial sector, such as Goldman Sachs and Visa, have reported varying earnings, adding to the DJIA’s overall performance metrics.

Additionally, international events, such as the ongoing conflict in Eastern Europe and trade negotiations with China, play a role in how domestic indices react to global markets. These factors remind investors that market stability can be precarious and success requires adaptability.

Conclusion

The Dow Jones Industrial Average remains a critical measure of stock market performance, influencing investment strategies across North America. Current trends indicate that while the index reached new heights in mid-2023, fluctuating economic conditions require vigilance for investors. Analysts forecast that with the coming economic reports and potential adjustments in Federal Reserve policy, the DJIA will continue to reflect broader market sentiments in the months ahead. Understanding these dynamics is essential for investors looking to navigate the complex landscape of financial markets.