Introduction to the Dow Jones

The Dow Jones Industrial Average (DJIA), a key indicator of U.S. stock market performance, consists of 30 significant publicly traded companies. As one of the oldest and most widely recognized stock market indices, the DJIA is crucial for investors and analysts as it reflects the health of the economy and investor sentiment.

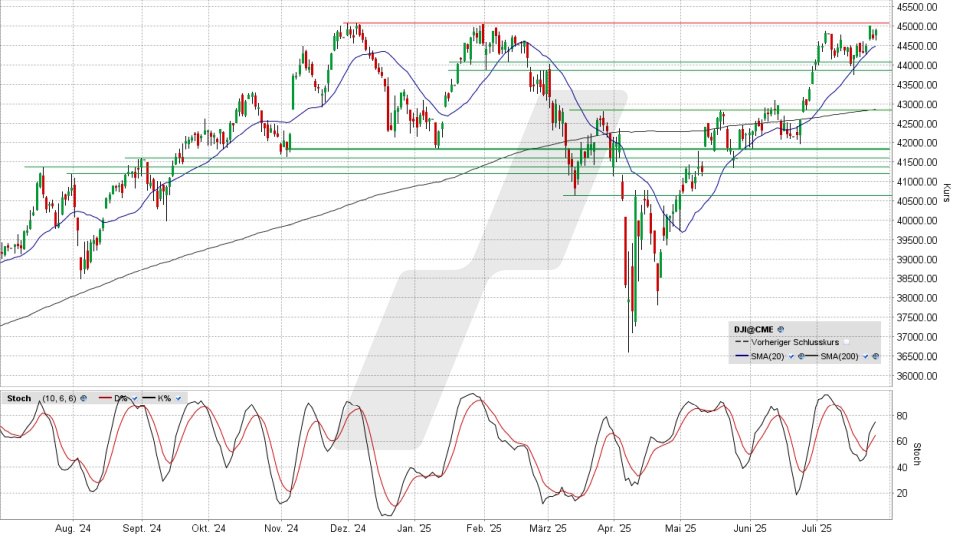

Recent Trends and Market Performance

In recent months, the Dow Jones has shown significant fluctuations influenced by various economic indicators, including inflation rates, employment data, and corporate earnings reports. As of mid-October 2023, the index hovered around the 34,000 mark, up approximately 8% year-to-date. Investors remain cautiously optimistic as the Federal Reserve maintains interest rates to combat inflation, balancing market growth with economic stability.

Notably, technology stocks have driven much of the Dow’s performance. Companies such as Microsoft, Apple, and Cisco have led gains, reflecting the ongoing demand for tech solutions despite economic uncertainties. Additionally, strong quarterly earnings have lifted market confidence, though concerns about potential recessions loom in the background.

Broader Economic Implications

The performance of the Dow Jones is not just a reflection of American businesses but also has far-reaching effects on global markets. As many foreign stocks are correlated to their U.S. counterparts, fluctuations in the Dow can sway international investments, exchange rates, and trade agreements. For instance, as the Dow rises, foreign investors may rush to U.S. markets, bolstering the economy. Conversely, a downturn can elicit a wave of selling, impacting investor confidence worldwide.

Future Outlook

Looking ahead, analysts predict a volatile but stable environment for the Dow Jones as the economy navigates potentially further tightening monetary policies and geopolitical tensions that could disrupt trade. Factors such as the ongoing conflict in Eastern Europe and supply chain disruptions in Asia continue to pose risks that might affect trade and consumer spending.

In summary, the Dow Jones remains a vital component for gauging the economic landscape in the U.S. and abroad. With careful monitoring of strategic economic indicators, investors and market watchers can better position themselves in an ever-changing market environment.