Introduction to the DJIA

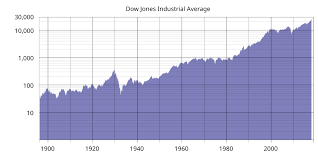

The Dow Jones Industrial Average (DJIA), one of the oldest and most referenced stock market indices, represents 30 significant publicly traded companies in the United States. Its importance lies in its ability to provide a snapshot of the performance of the industrial sector as well as the market as a whole, influencing investor sentiment and economic policies. In light of recent economic fluctuations and market disruptions, understanding the DJIA has become crucial for investors and analysts alike.

Recent Trends in the DJIA

In recent months, the DJIA has experienced considerable volatility, reflecting broader economic challenges such as inflationary pressures and geopolitical tensions. As of October 2023, the DJIA has shown resilience, gaining about 15% year-to-date amid fluctuating economic indicators. The recent Federal Reserve’s decision to maintain interest rates has also led to a temporary stabilization in market confidence. Industry giants making up the DJIA, including tech, healthcare, and consumer goods sectors, have reported mixed earnings, further influencing the index’s movement.

Factors Impacting the DJIA

Several key factors have been influencing the recent fluctuations of the DJIA:

- Inflation Rates: Persistent inflation remains a concern, affecting consumer purchasing power and corporate profitability, which could lead to potential adjustments in interest rates by the Federal Reserve.

- Geopolitical Issues: Ongoing international tensions, particularly concerning trade and military conflicts, have injected uncertainty into global markets, impacting investor confidence.

- Corporate Earnings: Quarterly earnings reports from major companies within the DJIA have provided insights into the health of various sectors. Strong earnings from tech giants have driven up the index, while disappointing results from the manufacturing industry have weighed it down.

Conclusion

The DJIA remains a critical barometer of economic health, reflecting both short-term fluctuations and long-term trends. As we move toward the end of 2023, analysts predict that continued monitoring of inflation, interest rates, and corporate performance will be essential for forecasting the index’s trajectory. Understanding the DJIA not only informs individual investment decisions but also provides insights into market dynamics that affect the broader economy. Investors should stay vigilant and informed about these trends to navigate the complexities of the stock market successfully.