Introduction

The price of gold has always been a point of interest for investors, economists, and the general public alike. As a valuable asset, gold often serves as a safe haven during economic uncertainty. With financial markets experiencing volatility due to various global events, understanding the current trends in gold prices is crucial for anyone interested in economic stability and investment strategies.

Current Trends in Gold Prices

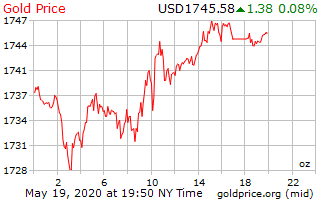

As of October 2023, gold prices have been on a significant rise, surpassing $2,000 CAD per ounce, a level not seen since earlier this year. This uptick can be attributed to several factors, including the ongoing geopolitical tensions and a fluctuating U.S. dollar. Analysts have observed that the rising inflation rates and potential interest rate cuts by central banks worldwide are also creating a favorable environment for gold investment.

Influencing Factors

1. **Geopolitical Uncertainty**: Recent conflicts and unrest in various regions have pushed investors towards gold as a ‘safe haven’ asset, which tends to retain value during times of instability.

2. **Inflation and Interest Rates**: Central banks, particularly the Bank of Canada and the U.S. Federal Reserve, have hinted at policy changes that might lower interest rates. Lower interest rates result in reducing the opportunity cost of holding gold, thereby increasing its appeal.

3. **Market Volatility**: The unpredictability of stock markets, primarily due to high inflation and energy price surges, has also prompted shifts in investor portfolios toward gold, leading to increased demand.

What Lies Ahead?

Markets experts are forecasting that gold prices could remain elevated in the near future, potentially reaching even higher levels if current economic conditions persist. The influence of rising global economic instability and investor sentiment will play key roles in determining the direction of gold prices moving forward.

Conclusion

For investors, understanding gold price trends is essential for making informed financial decisions. Whether using gold as a hedge against inflation or economic downturns, staying updated with the latest market dynamics can provide valuable insights. As future economic indicators unfold, gold is likely to maintain its critical role as an investment asset. Keeping an eye on global economic policies and geopolitical events will be crucial for predicting price movements in the gold market.