Introduction

The Consumer Price Index (CPI) inflation rate is a crucial economic indicator that measures the average change over time in the prices paid by consumers for goods and services. As inflation influences purchasing power, living standards, and economic policies, understanding its trends is vital for Canadians. Recent increases in CPI inflation rates have led to significant discussions among policymakers and citizens alike about the future of the economy.

Current CPI Inflation Trends

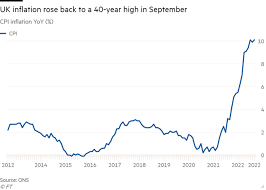

As of September 2023, Canada’s CPI inflation rate has reached a troubling 4.1%, up from 3.8% in August 2023. Analysts attribute this rise to several factors, including heightened demand for housing, increased energy prices, and supply chain disruptions stemming from global events. Recent data from Statistics Canada highlights that the cost of shelter, food, and transportation has greatly impacted the overall inflation rate.

The Consumer Price Index report shows that shelter costs, which account for a significant section of household spending, surged by 6.5% annually. Similarly, food prices rose by approximately 6.9% over the same period, with consumers feeling the pinch in grocery stores as prices for fresh produce and dairy products have soared.

Government Responses and Impact

In response to rising inflation, the Bank of Canada has proposed multiple interest rate hikes this year, aimed at cooling the economy and stabilizing prices. The central bank’s decision to increase rates has been consistent with its mandate to keep inflation at a target level of around 2%. However, mounting public pressure regarding affordability and housing crises has made this task challenging.

The introduction of various economic measures, such as the proposed housing reforms and temporary subsidies on energy, aims to alleviate some of the burdens consumers face due to higher prices. Despite these efforts, consumers continue to express frustration as they navigate a landscape marked by rising costs.

Forecast and Significance

Looking ahead, analysts predict that the CPI inflation rate will remain elevated in the short term but may stabilize towards the end of 2023. Factors such as global economic recovery, potential disruptions in supply chains, and seasonal variations will play pivotal roles. Experts suggest that policymakers must remain vigilant and responsive to economic indicators to mitigate the impact on citizens.

Ultimately, understanding the CPI inflation rate is essential for all Canadians. Staying informed about trends can help individuals and families make sound financial decisions in an ever-changing economic environment. As inflation continues to influence the economic climate, both consumers and policymakers must adapt and plan strategically.