Introduction

The inflation rate in Canada has been a topic of increasing concern for policymakers, consumers, and businesses alike in recent months. Understanding the dynamics of inflation is crucial as it impacts purchasing power, cost of living, and overall economic stability. As of mid-2023, the Canada inflation rate has witnessed significant fluctuations, raising questions about its future trajectory and implications for everyday Canadians.

Current Inflation Trends

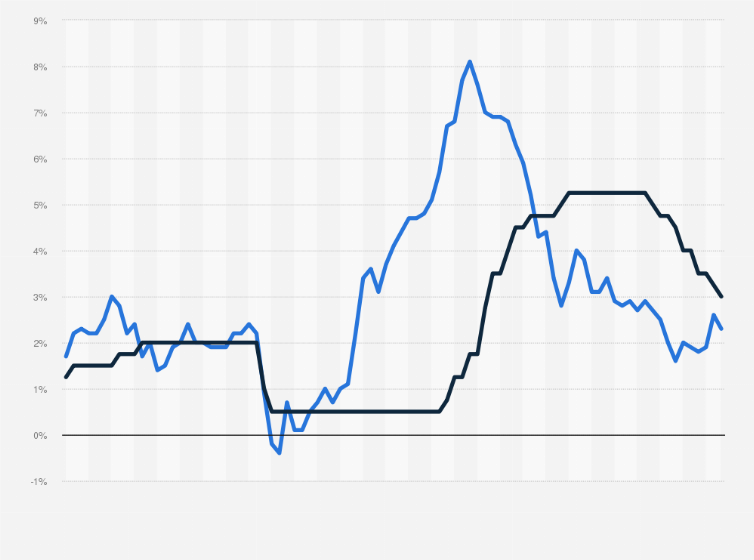

As reported by Statistics Canada, the annual inflation rate reached 5.2% in August 2023, a decrease from over 8% earlier in the year. This decline is attributed to stabilizing global supply chains and easing of pandemic-related restrictions. However, core inflation, which excludes volatile items such as food and energy, remains around 4.9%. The discrepancy between overall and core inflation stresses the complexity of the current economic climate.

Factors Influencing Inflation

Several factors contribute to the rising inflation rates observed in Canada. Supply chain disruptions, which began during the COVID-19 pandemic, continue to affect inventory and production costs. Additionally, increased consumer demand coupled with higher energy prices has further strained the market. The Bank of Canada has proposed interest rate hikes to mitigate inflation, but this has met with mixed opinions regarding its long-term effectiveness.

Economic Outlook

The Bank of Canada’s inflation target remains at 2%, suggesting that additional monetary policy changes may be on the horizon. Experts predict that while inflation may come down to around 3-4% by early 2024, consumers will still feel the pinch in their wallets. Economic growth is expected to slow as high borrowing costs influence consumer spending and business investments.

Conclusion

As the inflation rate in Canada fluctuates amidst various economic challenges, it is vital for Canadians to stay informed about its implications. Reduced purchasing power can significantly impact savings and investments, prompting households to adjust their budgets. Policymakers will need to balance between curbing inflation and supporting growth. Understanding the current trends and forecasts not only helps Canadians navigate their financial decisions but also fosters greater awareness of the economic landscape’s complexities. Moving forward, maintaining a close watch on inflation and related economic indicators will be essential for both individuals and businesses alike.