Introduction

The world of cryptocurrency has been a hot topic for years, but the recent fluctuations in the Bitcoin price have captured the attention of investors and economists alike. Bitcoin, the most well-known cryptocurrency, has become synonymous with digital currency and is often considered a barometer for the overall health of the crypto market. Understanding the factors driving Bitcoin’s price movements is crucial for both seasoned investors and newcomers.

Recent Price Movements

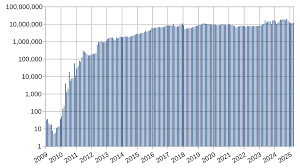

As of October 2023, Bitcoin’s price has witnessed significant volatility. In the past month, Bitcoin saw a surge, reaching values upwards of $60,000, only to retract to lower levels as market sentiments shifted. Market analysts attribute these fluctuations to a combination of regulatory news, macroeconomic factors, and technological developments within the blockchain space.

Factors Influencing the Bitcoin Price

Several key factors play a role in driving Bitcoin’s price:

- Market Sentiment: News regarding regulations, institutional adoption, and macroeconomic conditions can heavily influence investor sentiment, leading to price swings.

- Supply and Demand: Bitcoin’s supply is capped at 21 million coins, and as the demand increases, especially during market rallies, prices tend to rise.

- Technological Developments: Innovations such as the Lightning Network, which aims to facilitate faster transactions, can increase Bitcoin’s utility and subsequently its value.

- Global Economic Trends: Economic instability or inflation can drive investors towards Bitcoin as a hedge, increasing its price.

Current Outlook for Bitcoin Price

Experts are divided on the future trajectory of Bitcoin’s price. Some analysts predict that Bitcoin could reach new all-time highs by the end of 2023, buoyed by increased institutional investment and wider adoption. However, others caution that regulatory crackdowns in major markets could pose significant risks and potentially lead to sharp declines. Observing market trends and staying informed about global economic indicators will be crucial for those looking to navigate this volatile space.

Conclusion

In conclusion, the Bitcoin price remains a complex and ever-evolving subject, influenced by a myriad of factors including market sentiment, technology, and economic trends. For investors, understanding these variables is key to making informed decisions. As the crypto market continues to mature, staying updated on Bitcoin price movements will be more important than ever.