Introduction

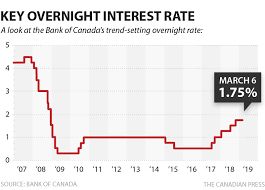

The Bank of Canada (BoC) plays a crucial role in the nation’s economy by setting interest rates that influence borrowing, spending, and overall economic growth. As inflation rises globally, the actions of the BoC in adjusting interest rates are of paramount importance. Recent trends have shown the bank’s efforts to control inflation and stabilize the economy, significantly impacting consumers and businesses across Canada.

Current Interest Rate Developments

As of October 2023, the Bank of Canada has maintained its key interest rate at 5.00%, a decision that reflects ongoing concerns about inflation, which is currently hovering around 3.4%. Following a series of hikes over the past year aimed at combating rising prices, the BoC is closely monitoring economic indicators to inform future rate decisions. Key areas of focus include consumer spending, housing market trends, and global economic conditions.

Impact on Consumers and Businesses

The decision to hold the interest rate steady means mixed implications for Canadians. For consumers, lower rates can translate into more affordable borrowing costs for loans and mortgages, encouraging spending and investment. However, the sustained high rate also reflects the bank’s caution regarding inflation, meaning higher costs on goods and services in the near future.

Businesses, particularly those dependent on loans for expansion and operations, are affected similarly. The interest rate environment influences funding availability and costs, shaping how companies plan for growth amidst economic uncertainty. Imports and exports are also impacted, as strong domestic interest rates can influence the Canadian dollar’s strength, affecting international trade dynamics.

Future Outlook

Looking ahead, the BoC’s commitment to controlling inflation remains a priority. Economic experts project that rates may begin to lower in late 2024, contingent on stabilizing inflation rates around the bank’s target of 2%. However, volatility in global markets, potential supply chain disruptions, and other factors could influence these forecasts.

Conclusion

The Bank of Canada’s interest rate decisions are critical for shaping the Canadian economic landscape. For consumers and businesses alike, understanding these changes is vital for effective financial planning. As we approach the end of 2023, keeping a close watch on the BoC’s policy statements and economic forecasts will be essential for all Canadians looking to navigate the complexities of our current economic climate.