Introduction to Telus Stock

Telus Corporation, one of Canada’s largest telecommunications companies, is a widely recognized player in the Canadian stock market. Investors closely watch Telus stock due to its consistent historical performance, dividends, and increasing demand for telecommunications services. As more Canadians rely on digital connectivity, understanding the movements within Telus stock becomes increasingly relevant for investors and market analysts alike.

Recent Performance and Market Trends

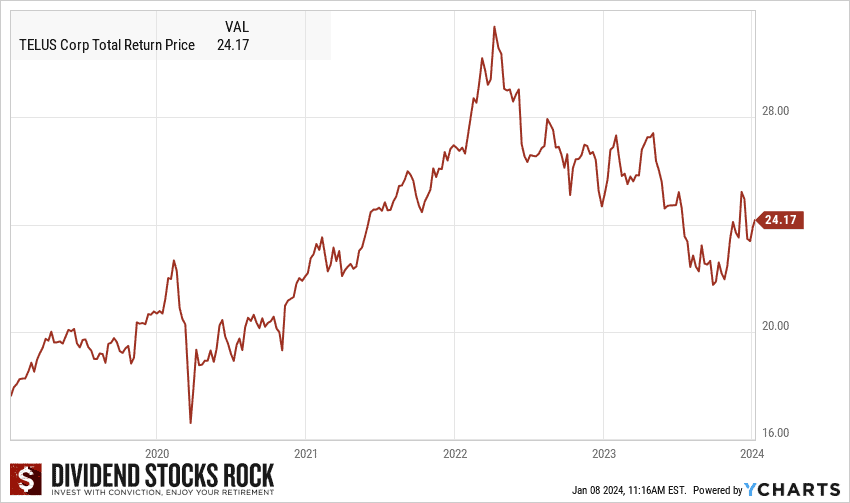

In recent months, Telus stock has shown resilience amid a volatile market. As of October 2023, the stock price has fluctuated around CAD 27.00, reflecting a relatively stable performance compared to some other equities in the telecommunications sector. Analysts have pointed to the company’s strong financial fundamentals, including sustained revenue growth driven by increased subscriber rates and expansions in both wireless and broadband services.

Furthermore, Telus continues to invest heavily in network infrastructure, which enhances its service offerings, including the rollout of 5G technology. This technological advancement not only positions Telus favorably in the market but also attracts a growing consumer base, which, in turn, reinforces positive investor sentiment.

Dividend Consistency and Investor Sentiment

Another noteworthy factor contributing to the allure of Telus stock is its reliable dividend payments. The company has a solid history of paying dividends, often drawing attention from income-focused investors seeking consistent returns. In 2023, Telus announced an annual dividend increase, reinforcing its commitment to delivering shareholder value. This consistent dividend policy is particularly attractive for those looking to invest in a stable, established company.

Market analysts are optimistic about Telus stock, predicting moderate gains in the near future. The ongoing shift towards digital and remote services, particularly post-pandemic, supports the growth narrative, and Telus is well-positioned to capitalize on these trends.

Conclusion and Future Outlook

In conclusion, Telus stock represents a compelling opportunity for both seasoned and new investors in the Canadian market. With a strong financial foundation, steady dividend payments, and a strategic focus on technological advancements, Telus continues to maintain a significant presence in the telecommunications industry. Investors are encouraged to keep a close watch on its stock performance and market developments as the industry continues to evolve. Looking ahead, as digital connectivity becomes more essential, Telus is poised for sustained growth, making it a noteworthy consideration for investment portfolios.