Introduction to SMCI Stock

As technology continues to evolve, stocks associated with innovative companies often attract significant investor interest. One such stock is SMCI (Super Micro Computer, Inc.), a key player in the high-performance computing and server market. With a growing demand for data center solutions and cloud computing, SMCI stock has seen notable fluctuations recently, making it a topic of interest for current and potential investors.

Recent Performance and Analysis

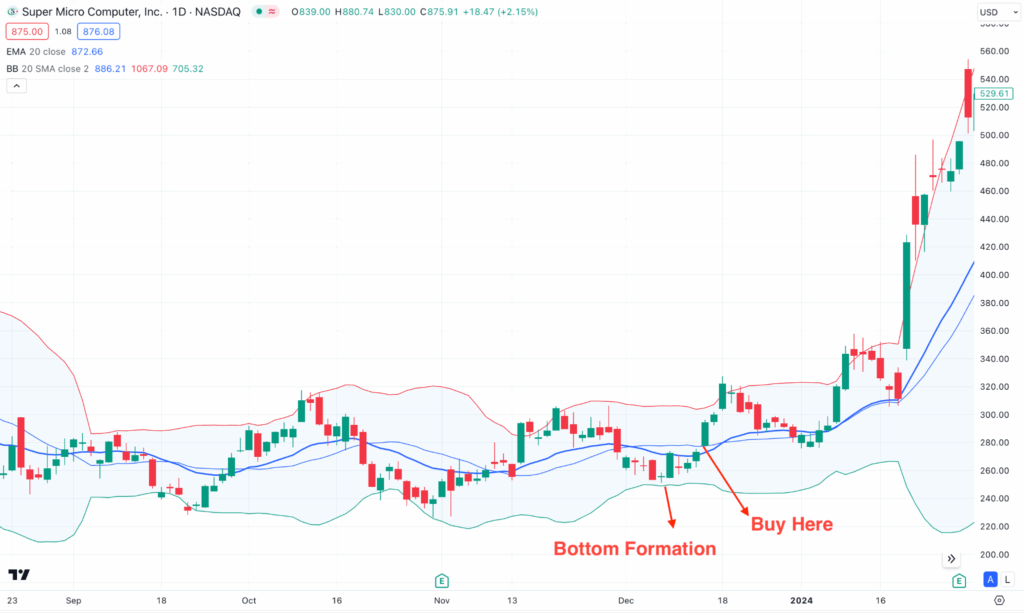

In the last quarter, SMCI stock has demonstrated considerable volatility. As of mid-October 2023, SMCI shares experienced a sharp increase of approximately 25% following the announcement of strong earnings that exceeded analyst expectations. The company reported a revenue increase of 40% year-over-year, driven by the rising demand for artificial intelligence (AI) and machine learning applications. The robust growth has led to optimism among investors regarding the company’s market position moving forward.

Analysts have been closely monitoring the stock, with a mix of bullish and bearish opinions. Some financial experts suggest that the stock could reach new highs if the company continues its trajectory of innovation and expansion in sectors like AI and cloud solutions. Conversely, others caution that potential supply chain disruptions and increased competition may pose risks in the upcoming quarters.

Market Trends Impacting SMCI Stock

The tech sector as a whole is undergoing substantial changes, heavily influenced by advancements in AI technology and the overall demand for enhanced computing power. As more businesses are adopting cloud infrastructure, companies like Super Micro Computer are positioned to benefit significantly. Industry reports indicate that the global cloud computing market is expected to grow at a compound annual growth rate (CAGR) of over 15%, which bodes well for SMCI’s long-term prospects.

Conclusion and Future Outlook

In light of current trends, SMCI stock presents an intriguing opportunity for investors looking to engage with the tech industry. While there are inherent risks associated with market fluctuations and competitive pressures, the company’s recent performance and the broader market potential suggest significant growth opportunities. Analysts recommend investors keep a close watch on the company’s strategic initiatives and market developments, as these will undoubtedly play a crucial role in shaping the future of SMCI stock. As we move toward 2024, the outlook for SMCI remains optimistic for those willing to navigate the inherent risks in this dynamic sector.