Introduction

In the realm of technology stocks, Super Micro Computer, Inc. (SMCI) has been making headlines recently due to its robust performance and strategic developments. As the tech industry continues to evolve, understanding the trajectories of stocks like SMCI is crucial for investors looking to capitalize on the dynamic nature of the market. With increased demand for high-performance computing solutions, SMCI’s stock has garnered significant attention, making it a focal point for investors.

Current Performance Trends

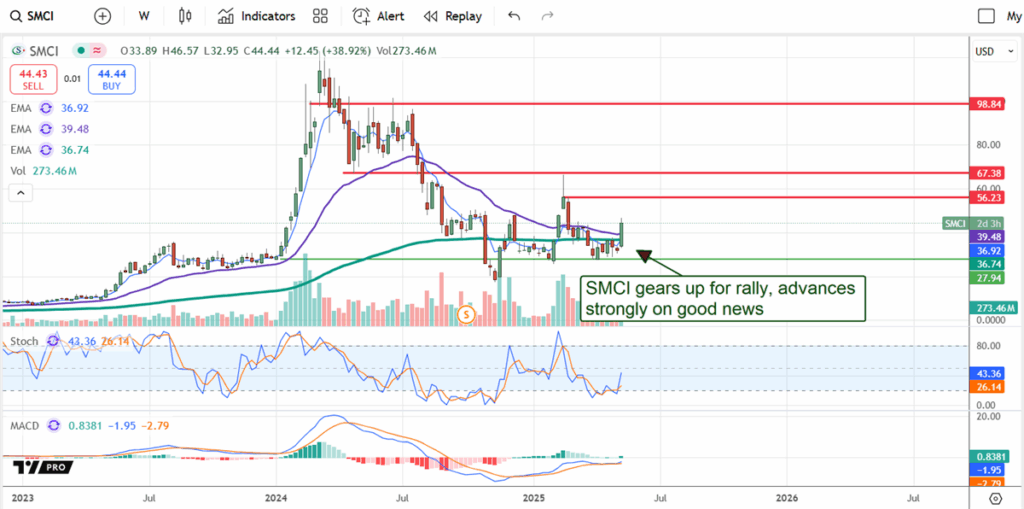

As of mid-October 2023, SMCI has seen an impressive surge in its stock value, driven in part by the global shift towards AI and data center solutions. Over the past year, SMCI’s share price has increased by over 150%, outperforming many of its peers in the semiconductor and hardware sectors. The company reported record revenues in its last quarterly earnings release, significantly exceeding analysts’ forecasts. Investors are particularly bullish following the announcement of strategic partnerships with major players in the tech industry, further solidifying SMCI’s position in the market.

Industry Context

The ongoing advancements in artificial intelligence and cloud computing have positioned companies like SMCI at the forefront of technological innovation. According to a recent report from Gartner, the global AI market is projected to surpass $500 billion by 2024. As a leading manufacturer of server and storage solutions optimized for AI workloads, SMCI stands to benefit tremendously from this growth. The firm’s rapid innovation cycle and commitment to delivering cutting-edge technologies are viewed favorably by analysts, who anticipate continued strong performance in the coming quarters.

Future Outlook

Looking ahead, analysts remain optimistic about SMCI’s stock. The company’s recent initiatives to expand its product offerings and enhance its supply chain capabilities are expected to drive further growth. Moreover, with ongoing global shifts towards digital transformation and enhanced data processing needs, SMCI is well-positioned to capitalize on emerging opportunities. However, potential market volatility and geopolitical factors may affect stock performance in the short term, necessitating vigilant observation from investors.

Conclusion

In summary, SMCI stock presents a compelling opportunity within the tech sector, thanks to its strong market position and responsive strategies to industry trends. As technology continues to advance and the demand for robust computing solutions rises, investors should consider the long-term growth potential of SMCI. However, they should also remain aware of the inherent risks associated with stock investments. As the company continues to innovate and adapt to market demands, keeping an eye on SMCI will be paramount for those interested in the tech market.