Introduction to SMCI Stock

As the technology sector continues to evolve, the performance of stocks like SMCI (Super Micro Computer, Inc.) becomes increasingly relevant for investors. SMCI has made headlines due to its innovative solutions in high-performance computing and its expansion in data center markets. With the rise of artificial intelligence and cloud computing, understanding the trajectory of SMCI stock is crucial for informed investment decisions.

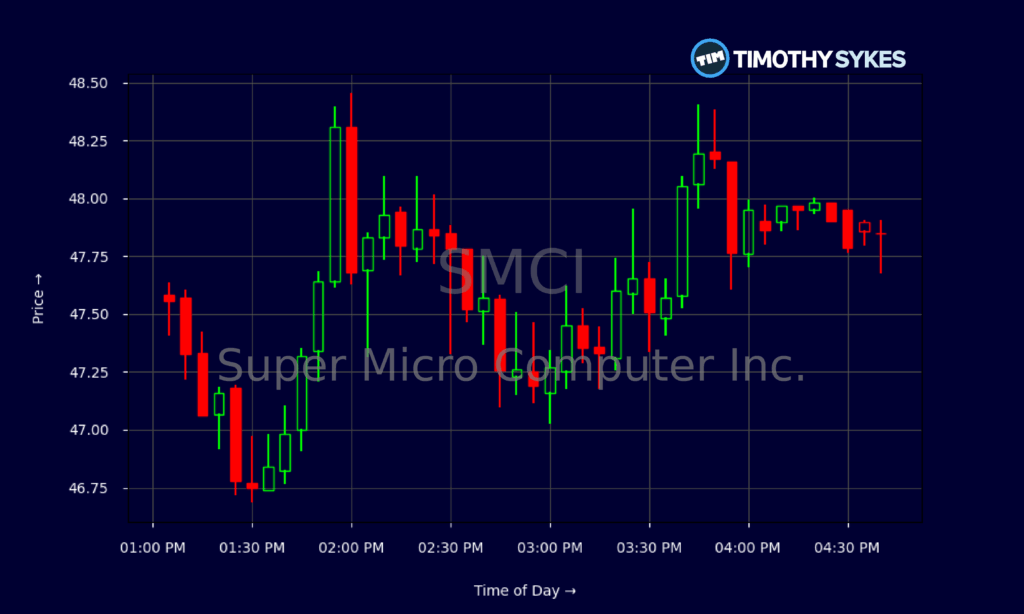

Current Market Performance

As of October 2023, SMCI stock has shown impressive growth, with a year-to-date increase of over 80%, significantly outperforming the broader technology sector. Analysts attribute this growth to several key factors, including robust financial results, strategic partnerships, and increasing demand for their high-density server solutions.

In its most recent quarterly report, SMCI reported revenues of $1.06 billion, up 70% year-over-year, exceeding analysts’ expectations. The company also posted a net income of $94 million, demonstrating strong profitability which has attracted institutional investors. Furthermore, SMCI’s focus on sustainability, such as energy-efficient server designs, positions it favorably in an industry increasingly focused on environmental responsibility.

Factors Influencing SMCI Stock

Several external factors impact the performance of SMCI stock. First, the growing emphasis on artificial intelligence (AI) has resulted in a surge in demand for the computing solutions that SMCI provides. As more companies invest in AI infrastructure, SMCI stands to benefit significantly. Moreover, federal investments in technology infrastructure amidst increasing cybersecurity threats have bolstered the company’s market presence.

However, challenges such as supply chain constraints and international trade tensions may affect future performance. Investors are advised to monitor these variables closely as they could impact SMCI’s operations and stock performance in the coming months.

Conclusion and Future Outlook

In conclusion, SMCI stock has demonstrated remarkable growth and resilience in the current market, driven by strategic innovations and increasing demand for servers in a digital world. Analysts remain optimistic about the company’s trajectory, forecasting continued gains as the data center market expands. However, potential investors should remain vigilant regarding market volatility and external factors that could influence SMCI’s long-term performance.

As the landscape of technology continues to change, staying informed about stocks like SMCI will be essential for making sound investment decisions. With its focus on innovation and sustainability, SMCI is poised to play a significant role in shaping the future of high-performance computing.