Introduction

PayPal Holdings, Inc. (Ticker: PYPL) has remained a significant player in the fintech industry, providing digital payment solutions to millions around the globe. As the digital payment landscape continues to evolve, investors closely monitor PYPL stock due to its performance, potential, and the impacts of economic trends. The relevance of tracking PYPL stock has increased lately, with investors observing its fluctuating market value and the company’s strategic responses to competition and economic shifts.

Recent Stock Performance

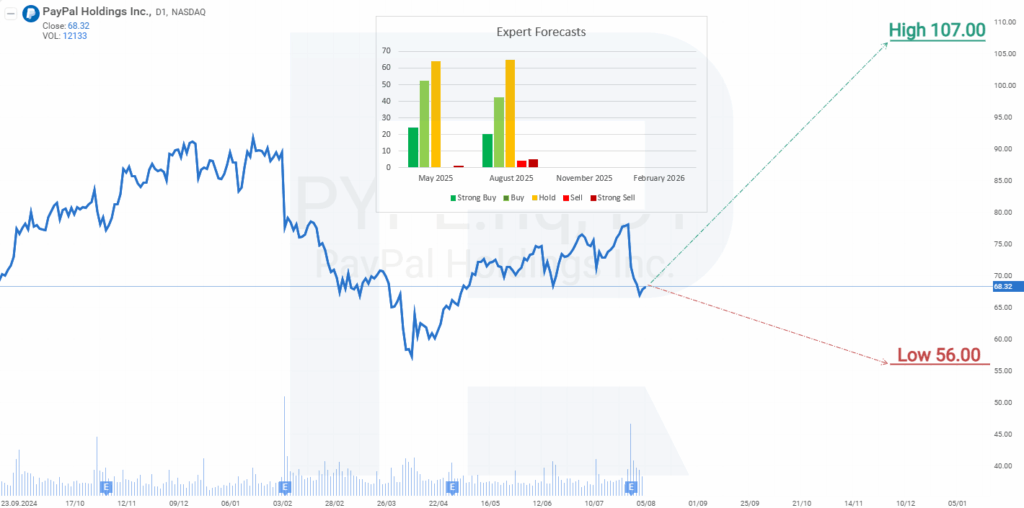

As of mid-March 2023, PYPL stock has exhibited volatility, reflecting broader market trends and investor sentiments. After reaching a high of approximately $300 in early 2021, the stock faced challenges, dipping below $70 by mid-2022. However, recent analyses indicate a potential recovery, with PYPL stock trading around $95 as of this week. Analysts attribute this rebound to strategic pivots initiated by PayPal, including an investment in cryptocurrency services and improved user acquisition strategies.

Key Developments

PayPal has made headlines for its recent partnerships and collaborations which aim to enhance customer experience and broaden its user base. The introduction of “PayPal Zettle,” a point-of-sale payment system, exemplifies its commitment to capturing small business customers. Furthermore, the company’s foray into cryptocurrency has attracted younger investors, adding a new dimension to its portfolio.

Moreover, the tech giant has faced challenges from competitors like Square and traditional financial institutions, which have aggressively expanded their digital offerings. Despite these challenges, PayPal’s established brand recognition and extensive user base give it a significant competitive edge.

Future Outlook

Investors are keeping a close eye on PYPL stock’s potential for growth in the coming quarters, especially as the global economy rebounds from the COVID-19 pandemic. With the anticipated resurgence of consumer spending and e-commerce, PayPal is well-positioned to leverage its existing infrastructure to drive profits. Analysts forecast a potential increase in the stock price as the company continues executing its growth strategies. However, the market remains sensitive to interest rate hikes and inflation rates that could lead to market corrections.

Conclusion

In summary, PYPL stock remains a topic of interest for many investors as it navigates through current economic conditions while adapting to competition and market demands. The company’s initiatives in diversifying its offerings and enhancing its brand presence may play a critical role in driving its stock performance moving forward. For current and potential investors, staying informed about PayPal’s strategies and market dynamics will be crucial for making informed investment decisions.