Introduction to Pltr Stock

Palantir Technologies (ticker: PLTR) has garnered much attention in the financial world due to its unique offerings in data analytics and artificial intelligence. As a company founded in 2003 and publicly traded since 2020, PLTR serves various sectors including government, financial services, and healthcare. The relevance of Pltr stock has surged lately as institutional interest increases and market dynamics evolve, making it essential for investors to stay informed.

Recent Performance of Pltr Stock

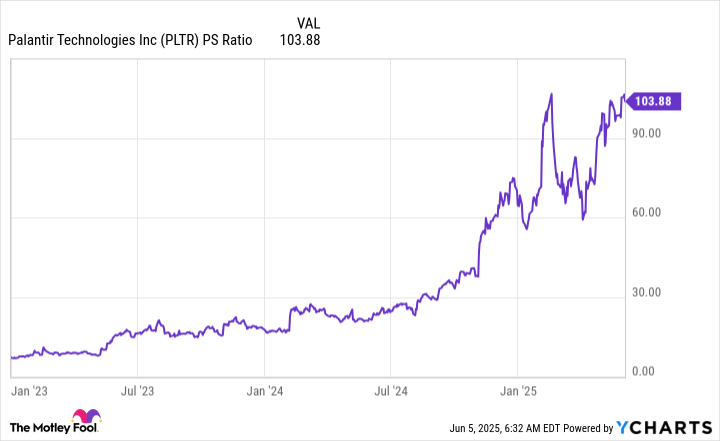

As of October 2023, Pltr stock’s performance has seen significant fluctuations. After its initial public offering at $10 per share, the stock reached an all-time high of nearly $45 in early 2021 amid the tech market’s surge. However, recent trading has experienced volatility, influenced by broader market conditions, earnings reports, and geopolitical events. Analysts note that Pltr shares are currently trading in the range of $15 to $20, leading to debates regarding its valuation and future trajectory.

Key Events Impacting Pltr Stock

Several key factors have influenced Pltr stock’s recent pricing. One notable event was the earnings report released in September 2023, where Palantir reported a revenue increase of 12% year-over-year. Despite the growth, the company faced scrutiny for not meeting market expectations concerning profitability. Analysts are divided on whether the current price reflects an attractive buying opportunity or whether caution is warranted considering potential competition in the data analytics space.

Furthermore, developments surrounding government contracts have been critical. Palantir recently secured a contract with the U.S. Department of Defense, showcasing its steady role in critical national security operations. This kind of endorsement can bolster investor confidence, suggesting long-term stability amidst short-term volatility.

Conclusion and Future Outlook

In summary, Pltr stock remains a focal point for investors interested in technology and data analytics. With recent fluctuations, ongoing evaluations of its market position, and critical government contracts, the outlook for PLTR is a mixed bag. Investors should consider both the potential for growth in the evolving tech landscape and the associated risks driven by market competition and performance metrics. The next earnings report in November 2023 will likely be a decisive factor in determining the stock’s trajectory in the coming months.