The Significance of Pfizer Stock in 2023

Pfizer Inc., one of the world’s largest pharmaceutical companies, has been a focal point in the stock market, particularly due to its development of the COVID-19 vaccine. The relevance of Pfizer stock extends beyond just its vaccine success; it represents broader trends in pharmaceutical research and public health.

Current Market Performance

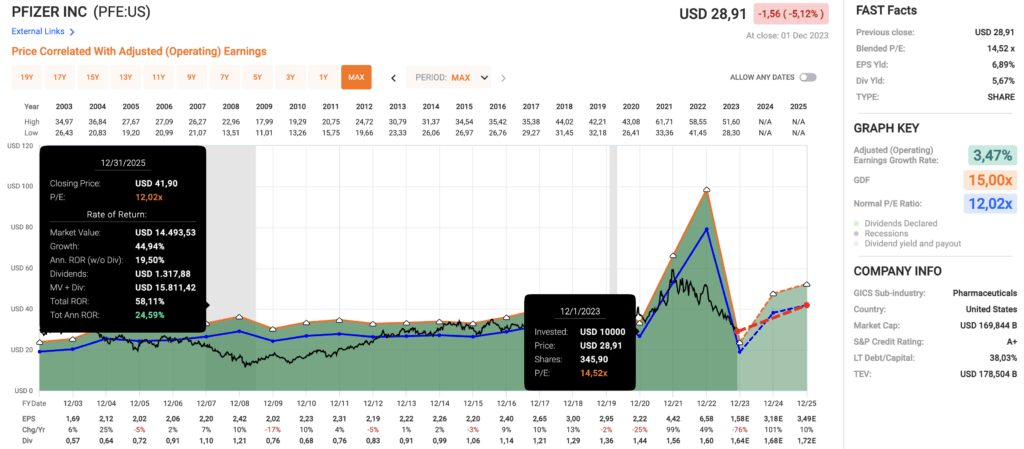

As of October 2023, Pfizer’s stock has seen significant volatility influenced by factors such as patent expirations, research and development updates, and healthcare policy changes. Following an impressive surge during the height of the pandemic, Pfizer’s stock has corrected, reflecting the anticipated decrease in vaccine revenues as the pandemic phase shifts towards endemic management.

Recent reports indicate that Pfizer stock has fluctuated around $30-40 per share, a decrease from its peak of approximately $60 in mid-2021. Analysts are closely watching quarterly earnings that are set to be released later this month, which may provide insights into the company’s current revenue streams and future outlook. Key analysts are divided on whether Pfizer stock represents a buying opportunity or a continued risk due to potential losses in COVID-19 vaccine revenue.

Future Outlook and Predictions

Looking ahead, many analysts foresee a mixed outlook for Pfizer stock. On one hand, the company is not solely reliant on its vaccine; it has an extensive pipeline of drugs aimed at treating various diseases, including cancer and rare genetic disorders. New product launches and sustained prescription growth could strengthen its position in the market, potentially boosting stock performance.

However, significant challenges remain, including increased competition from generic drugs and other pharmaceutical companies entering the same markets. Furthermore, geopolitical factors and regulatory changes may also influence Pfizer’s operations and stock performance moving forward.

Conclusion: The Importance for Investors

In conclusion, Pfizer stock remains a critical barometer for the pharmaceutical industry and healthcare investments. For investors, understanding the factors affecting Pfizer’s stock—such as market conditions, company news, and global health trends—is crucial for making informed decisions.

The future of Pfizer stock is likely to be shaped not only by its past successes but also by its ability to innovate and respond to evolving health needs. As always, potential investors should conduct thorough research and consider consulting financial advisors to navigate this dynamic market landscape effectively.