Introduction

Palantir Technologies Inc. has become a focal point in the technology and finance sectors due to its unique approach to data integration and analytics. The stock has attracted significant attention from both institutional and retail investors, particularly in light of the company’s increasing contracts with government and commercial entities. As the tech landscape evolves, tracking Palantir’s stock performance is critical for investors seeking to understand the broader implications of its services in a data-driven world.

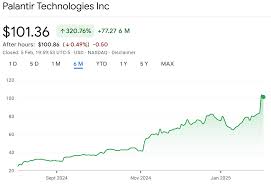

Recent Stock Performance

As of October 2023, Palantir’s stock (NYSE: PLTR) has shown noteworthy fluctuation, trading around $20 per share, with an approximate year-to-date increase of 45%. This surge can largely be attributed to the company’s successful defense contracts and its growing deployments in various sectors, including healthcare and finance. Analysts have pointed out that the firm’s strong quarterly earnings, which exceeded market expectations, played a pivotal role in enhancing investor confidence. In its most recent earnings call, Palantir reported a revenue increase of 20% year-over-year, which has bolstered its valuation amidst a turbulent market.

Key Factors Influencing Stock Movements

Several factors are influencing the performance of Palantir stock. Firstly, the company’s strategic partnerships with U.S. government agencies, including the Department of Defense, have not only provided a steady revenue stream but also positioned Palantir as a crucial player in national security operations. Furthermore, the global emphasis on artificial intelligence (AI) and big data analytics has created a favorable environment for Palantir’s services. Market analysts also cite the impending launch of Palantir’s new AI-driven tools as a significant catalyst for future stock performance.

Risks and Challenges

Despite its promising growth, investing in Palantir stock does come with inherent risks. Market volatility, regulatory scrutiny, and competition from both established tech giants and emerging startups pose challenges to sustained growth. Moreover, concerns regarding the company’s reliance on government contracts may impact its future performance, especially if there are budget cuts in defense spending. Investors should also be aware of the company’s historically high valuation metrics, which could lead to corrections if growth expectations are not met.

Conclusion

In conclusion, Palantir stock represents both opportunity and risk in the current market landscape. With its innovative technologies and strong government presence, the company is poised for growth in the data analytics sector. However, potential investors should remain cautious of the underlying risks while keeping a close watch on emerging trends and market conditions. As Palantir continues to diversify its client base and expand its offerings, its stock will likely remain a barometer for investor sentiment in the tech market.