Introduction

In recent years, Palantir Technologies, a leader in data analytics and software, has garnered significant attention from investors and analysts alike. The company’s innovative solutions for data integration and analysis have positioned it as a crucial player in various industries, including government, finance, and healthcare. Understanding Palantir’s stock performance is imperative for investors looking to capitalize on the increasing demand for data intelligence solutions.

Recent Developments

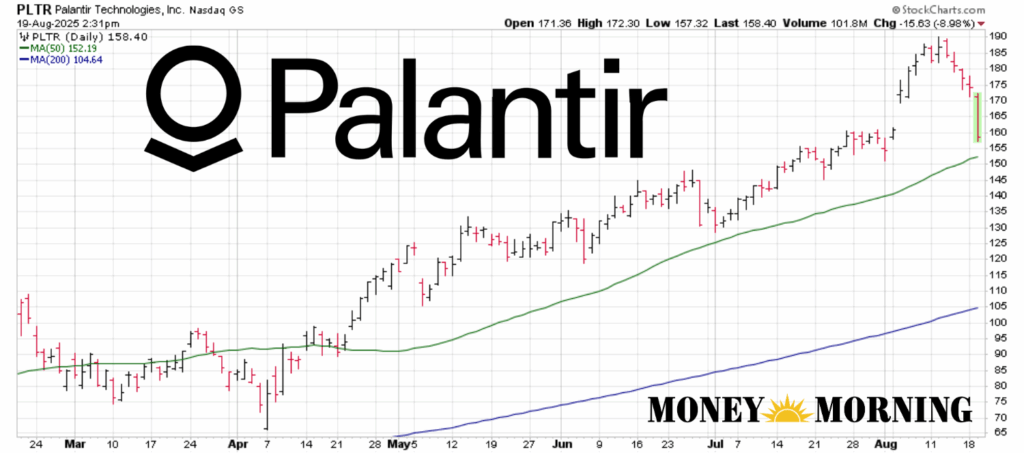

As of October 2023, Palantir’s stock has experienced notable fluctuations, primarily influenced by broader market conditions and its quarterly earnings reports. In the latest earnings call, the company reported a revenue increase of 20% year-over-year, driven by substantial contracts with federal government agencies and a growing client base in the private sector. Analysts praised the company’s ability to maintain a strong pipeline of contracts, which bodes well for its future growth.

Moreover, the company is expanding its operations internationally and enhancing existing relationships, which is contributing to a more diversified revenue stream. This development has made Palantir stock a topic of discussion among investment gurus, especially given the rise of artificial intelligence and machine learning, where Palantir’s technology excels.

Market Sentiment

Investor sentiment surrounding Palantir stock appears cautiously optimistic. Recent reports indicate that hedge funds and institutional investors are increasingly adding Palantir to their portfolios, acknowledging its potential as a long-term growth asset. However, some analysts express concern about the company’s dependency on government contracts, which can be vulnerable to political shifts.

Additionally, there are ongoing discussions about Palantir’s valuation, which, according to some financial experts, may be on the higher side relative to its earnings. This has led to mixed recommendations from analysts, with some advocating for cautious buying while others suggest waiting for a more favorable entry point.

Conclusion

Overall, Palantir stock remains a focal point for investors interested in technology and data analytics. As the world increasingly relies on data-driven decisions, the opportunity for companies like Palantir is set to expand. While current market uncertainties and valuation discussions pose challenges, the strong quarterly performance and growth potential make it a stock worth monitoring closely. Investors should stay informed about technological advancements and market trends to better gauge the future trajectory of Palantir stock.