Introduction

The stock market is a dynamic environment, and understanding individual stocks can provide valuable insights for investors. One such stock that has garnered attention is OSCR, the stock of Oscar Health, Inc. As a prominent player in the health insurance sector, particularly among technology-driven companies, the performance of OSCR stock holds significant relevance for investors and analysts alike. This article delves into the recent developments surrounding OSCR stock and explores what the future might hold in this ever-changing market.

Recent Developments

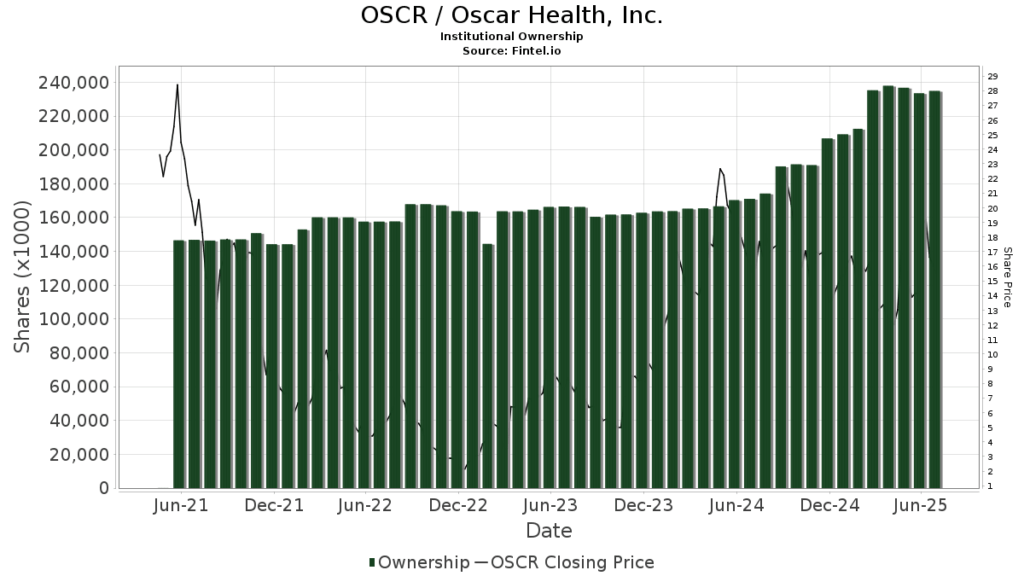

As of late 2023, OSCR stock has shown fluctuations in its performance, sparking interest from market analysts. Following its initial public offering (IPO) in March 2021, Oscar Health faced various challenges, including competition from traditional healthcare providers and evolving regulatory environments. However, recent earnings reports indicate a stabilization in their business model. As of October 15, 2023, OSCR shares were trading at approximately $9.50, reflecting a change of +2.1% over the past month.

Analysts attribute this uptick to several factors, including increased demand for digital health solutions during the pandemic and favorable regulatory adjustments that have allowed companies like Oscar Health to showcase their unique offerings. Additionally, significant partnerships with major healthcare organizations to expand their services have contributed positively to investor sentiment.

Financial Performance

In its latest earnings call, Oscar Health reported a revenue increase of 21% year-over-year. However, despite this growth, the company has not yet turned a profit, which continues to be a concern among investors. The management emphasized their commitment to achieving profitability by managing costs and enhancing operational efficiencies, which they believe will drive better performance in the long run.

Conclusion

For investors navigating the stock market, the fluctuations of OSCR stock underscore the importance of keeping abreast of market trends and company developments. While Oscar Health continues to face hurdles in achieving profitability, its growth potential within the digital health space and strategic partnerships may present favorable opportunities for investors looking to enter or expand their positions. Moving forward, it will be essential to monitor the company’s quarterly reports and market conditions, as they can significantly impact the direction of OSCR stock. As the landscape of health insurance evolves with technological advancements, Oscar Health’s adaptability will play a crucial role in its success and sustainability in the competitive market.