Introduction

Opendoor Technologies Inc. has become a significant player in the real estate sector, offering a unique solution for buying and selling homes. Given the shifting dynamics of the market and the challenges brought about by economic factors like inflation and interest rates, understanding Opendoor’s stock performance is essential for investors and stakeholders alike. As the housing market shows signs of fluctuation, insights into Opendoor’s stock are even more relevant.

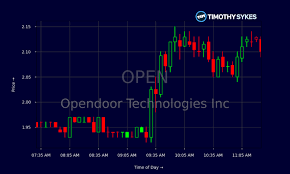

Current Market Performance

As of October 2023, Opendoor’s stock has experienced notable volatility. After launching on the NASDAQ through a SPAC merger in late 2020, the stock reached its all-time high in early 2021 but has since struggled to maintain that momentum. Current trading figures indicate that Opendoor stock is hovering around $3.50, a significant drop from its peak above $30. The decline can be attributed to various factors, including rising mortgage rates and decreased consumer appetite for home purchases. Analysts are closely watching how these trends impact Opendoor’s revenue and overall business model, which relies heavily on rapid home transactions.

Recent Developments

In its recent quarterly earnings report, Opendoor reported a lower-than-expected revenue, driven by a slowdown in home sales. The company reported $3 billion in revenue for the third quarter, down from $3.5 billion the previous year. This decline signals ongoing challenges in the housing market, where buyers are becoming increasingly cautious amid economic uncertainty.

To counteract these challenges, Opendoor has focused on cost-cutting measures and refining its business strategy. This includes expanding their product offerings and improving user experience on their digital platform, aiming to attract a larger customer base during uncertain times. Analysts believe that these strategic initiatives could position Opendoor for potential recovery as the housing market stabilizes.

Future Outlook

Looking ahead, many analysts remain cautiously optimistic about Opendoor’s stock. The real estate tech sector is expected to evolve as technology plays a more significant role in home buying and selling. As the market responds to fluctuations, investors are advised to keep an eye on macroeconomic indicators and housing market trends that will likely influence Opendoor’s stock performance.

In conclusion, while Opendoor’s stock has faced considerable challenges in recent months, the company’s adaptation strategies and innovations may offer a path towards recovery. Investors should remain vigilant and consider broader market conditions as they assess the future potential of Opendoor in the evolving real estate landscape.