Introduction to Old Age Security (OAS)

The Old Age Security (OAS) program is one of Canada’s fundamental pensions, ensuring that seniors have a basic income in retirement. Established in 1952, it reflects Canada’s commitment to the well-being of its older population as they navigate financial independence during their retirement years. OAS is particularly relevant today, as more Canadians are entering retirement, highlighting the importance of financial security for aging citizens.

Eligibility and Benefits of OAS

To qualify for OAS, residents must be at least 65 years old and have lived in Canada for at least 10 years after the age of 18. The amount received depends on the length of residence in Canada, with the maximum monthly benefit being approximately $615.37 as of January 2023. Furthermore, OAS benefits are adjusted quarterly based on the Consumer Price Index, ensuring that seniors maintain their purchasing power over time.

Recent Developments and Changes

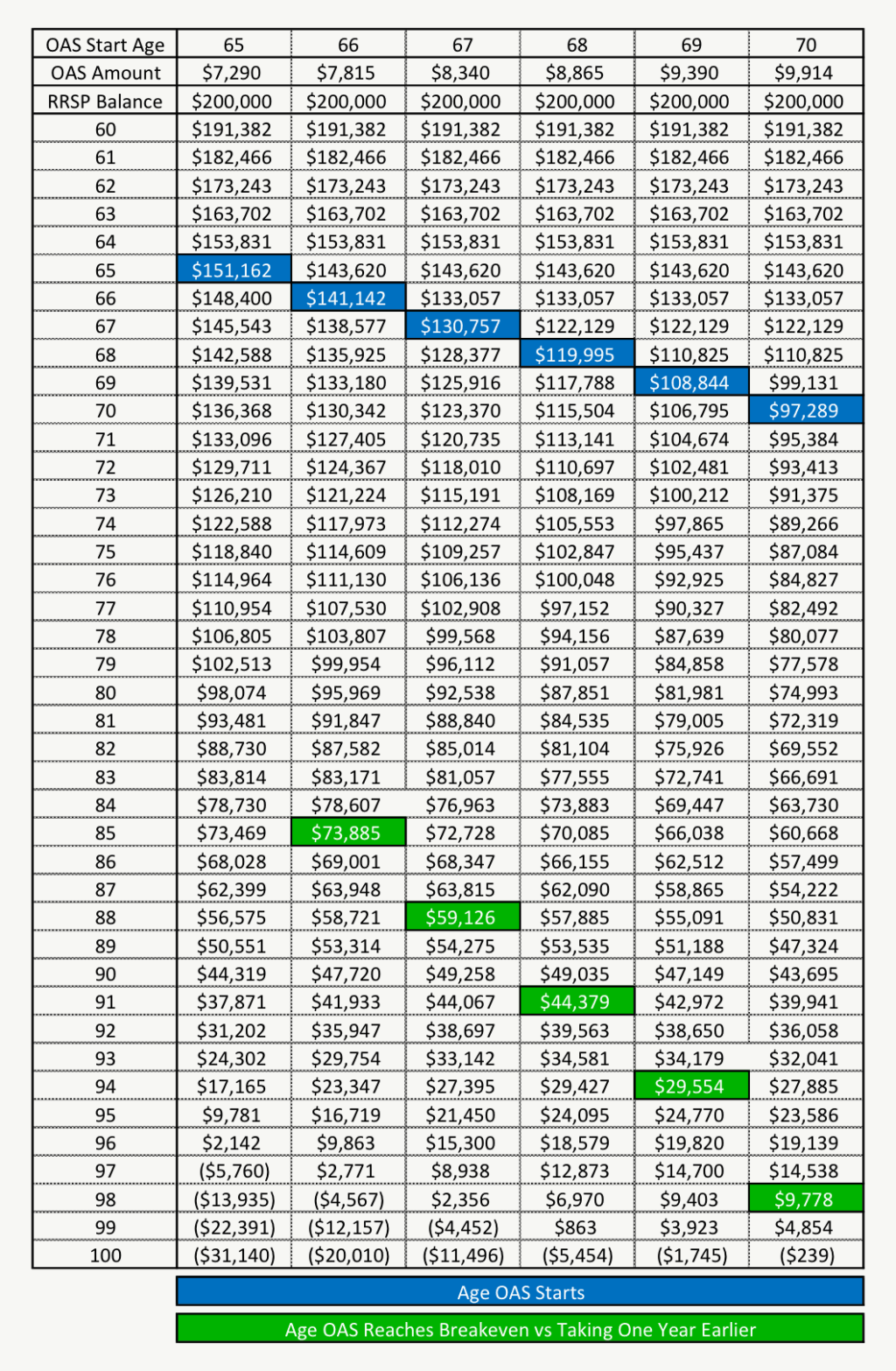

In recent months, the OAS program has seen adjustments, such as increases in benefits to cope with inflation and the rising cost of living. In July 2023, the government announced an increase in the OAS payment due to significant inflation rates, reflecting ongoing concerns about food and housing costs for seniors. Additionally, discussions regarding the OAS eligibility age have surfaced, with some policymakers suggesting that raising the age from 65 to 67 may be necessary to address fiscal sustainability in the long run. However, these discussions have sparked debates across various communities, prompting protests from senior advocates.

Future Outlook for OAS

Looking ahead, the OAS program remains a vital component of Canada’s social safety net. Analysts predict that as the baby boomer generation continues to age, pressure on the program will increase. This situation calls for ongoing evaluations and possible reforms to ensure that the OAS can sustainably support future generations of seniors. Canadians are encouraged to keep informed about potential changes to their benefits, as the financial landscape for retirees is likely to evolve based on economic conditions and government policies.

Conclusion

The Old Age Security program is crucial for ensuring that seniors in Canada enjoy a dignified retirement. As the population ages and new challenges arise, staying informed about the program’s benefits and potential changes is essential for all Canadians. The OAS will undoubtedly continue to be a significant aspect of the financial security and well-being of older adults in Canada.