Introduction

The stock of NBIS, a growing company within the biotechnology sector, has been attracting attention from investors and analysts alike. With its focus on innovative treatments and groundbreaking research, understanding the stock’s performance, current trends, and future prospects is crucial for investors considering their position in the market.

Current Performance and Market Trends

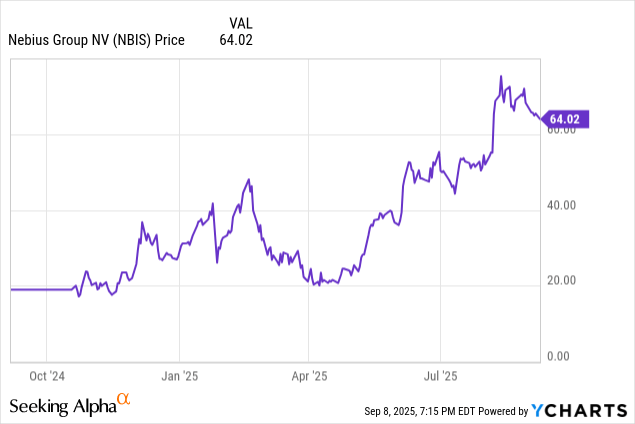

As of the latest trading data, NBIS stock has been experiencing volatility, with fluctuations largely driven by broad market trends and specific news relating to the company’s clinical trials and product development. Over the past few months, NBIS has shown a notable increase, closing at $7.50 a share, a rise attributed to the positive outcomes from its recent drug trial for neurological disorders. Investors reacted favorably to the announcement, reflecting optimism regarding future revenue streams.

According to market analysts, the average target price for NBIS stock is currently set around $9 per share, representing a potential upside that appeals to both short-term traders and long-term investors. The increased interest in biotech stocks, spurred by advancements in medical science and the ongoing public health crisis, has resulted in a bullish sentiment surrounding NBIS.

Recent Developments

NBIS has made headlines recently due to its collaborations with major pharmaceutical companies to enhance research capabilities and improve market penetration. This collaboration is expected to accelerate the development of key therapies and could position NBIS favorably in a competitive landscape. Furthermore, the company’s leadership has outlined strategic plans for expanding their research pipeline, which directly influences stock performance based on anticipated future launches.

Moreover, regulatory updates are vital for the stock’s trajectory. Positive signals from regulatory bodies regarding its therapy approval would likely result in increased investor confidence, leading to a potential rise in share value.

Conclusion

In conclusion, NBIS stock presents both opportunities and risks for investors. The recent positive performance driven by successful trial outcomes, strategic partnerships, and favorable market conditions makes it attractive. However, potential investors should also consider the inherent volatility and sector-specific risks. Keeping an eye on future developments, such as product approvals and market expansions, will be essential for making informed investment decisions. As the biotechnology sector continues to evolve, NBI’s stock may very well be a focal point for those looking to capitalize on growth in this innovative field.