Introduction

Lulu stock, representing the shares of Lululemon Athletica Inc., has become a focal point for investors and market analysts. As a leading sportswear retailer known for its innovative designs and high-quality materials, Lululemon’s stock performance resonates not only with athletic enthusiasts but also with global investors. The importance of this topic lies in the broader implications of retail performance in a recovering economy as financial markets react to changing consumer behaviors.

Recent Performance

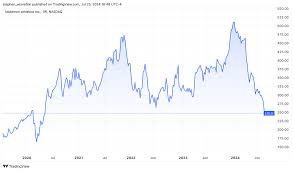

As of early October 2023, Lululemon’s stock has shown resilience amidst fluctuating market conditions. The company recently reported a quarterly revenue of $2.2 billion, surpassing analysts’ expectations. This was a growth of 25% compared to the previous year. Such performance can be attributed to increased online sales and the successful launch of new product lines, indicating strong consumer demand.

Market Sentiments and Factors Affecting Stock Price

The stock price of Lulu has seen significant volatility influenced by several factors, including overall market trends, shifts in consumer spending, and supply chain disruptions. Recent macroeconomic data indicate improved consumer confidence, which positively affects retail stocks like Lululemon. However, analysts are cautiously optimistic, warning that inflationary pressures and potential hike in interest rates could pose risks in the near future.

Future Outlook

Forecasts for Lulu stock suggest growth potential, primarily driven by the brand’s strong e-commerce strategy and continued expansion into international markets. Several analysts predict that Lululemon may also leverage collaborations with fitness influencers and community engagement initiatives to enhance its brand presence. If these strategies are executed effectively, they could help solidify Lululemon’s position in the competitive sportswear market.

Conclusion

Lulu stock remains an intriguing investment option as it balances growth opportunities against potential market risks. For investors, staying informed about Lululemon’s strategies and market dynamics will be crucial in making well-rounded decisions. The company’s ability to adapt to changing consumer preferences while navigating economic uncertainties could significantly impact its stock performance moving forward. Consequently, keeping an eye on Lulu stock trends will benefit both investors and market watchers looking to understand the retail landscape.