Introduction

The stock of Intuitive Surgical, Inc. (NASDAQ: ISRG), well-known for its robotic surgical systems, is attracting investor attention as the company continues to revolutionize the minimally invasive surgical field. With the growth in healthcare technology and rising demand for robotic-assisted surgeries, understanding ISRG stock is crucial for investors looking to tap into this dynamic market.

Current Trends in ISRG Stock

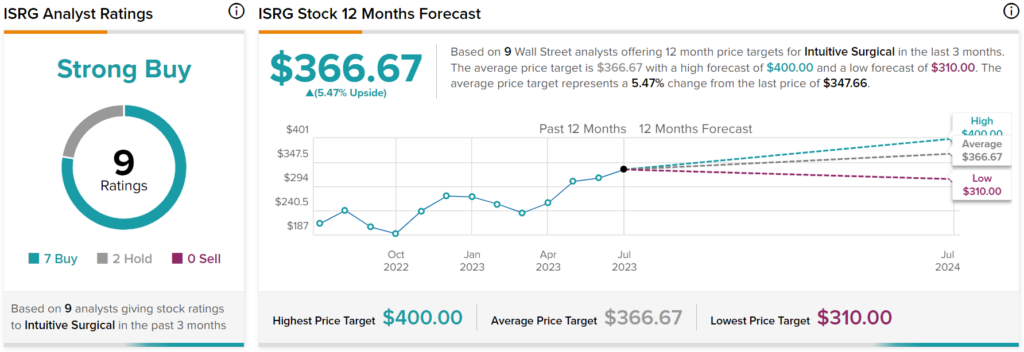

As of mid-October 2023, ISRG stock has shown resilience amid market volatility. After experiencing a remarkable increase of over 30% from the start of the year, the stock reached around $370 per share last week. Analysts attribute this growth to several key factors:

- Sales Growth: The company’s third-quarter earnings report indicated a revenue growth of 20% year-over-year, primarily driven by an increase in surgical procedures using the da Vinci Surgical System.

- Innovations and Expansions: Intuitive Surgical recently announced several partnerships aimed at expanding its product offerings, including the development of new robotic technologies and software enhancements that allow for better surgical precision.

- Market Position: Intuitive holds a strong market position due to its established brand and product range, bolstered by increasing healthcare investments globally.

Challenges Ahead

Despite positive growth indicators, ISRG stock faces challenges that investors should consider:

- Increasing Competition: The medical robotics field is becoming competitive, with various companies entering the market and developing alternative surgical systems.

- Regulatory Hurdles: The approval process for new technologies in the medical field can be lengthy and costly, posing potential risks to the company’s timelines for product launches.

- Market Conditions: Macroeconomic factors, including rising interest rates and inflation, could impact healthcare spending, thus affecting sales and stock performance.

Conclusion

In wrapping up, ISRG stock embodies the intersection of healthcare innovation and investment potential. With the current momentum, investors may find opportunities, but it’s essential to be aware of the inherent challenges in the evolving medical technology landscape. Analysts predict that if Intuitive Surgical maintains its innovation trajectory and effectively navigates market conditions, ISRG could continue to show robust growth. Therefore, keeping an eye on both market trends and the company’s strategic moves will be essential for informed investment decisions.