The Rise of Quantum Computing and IonQ’s Position

In recent years, the field of quantum computing has gained tremendous attention, not only from technologists and researchers but also from investors looking for the next big opportunity. IonQ, a pioneering company in this space, has emerged as a key player in the market, attracting significant investor interest due to its groundbreaking technology and strategic partnerships.

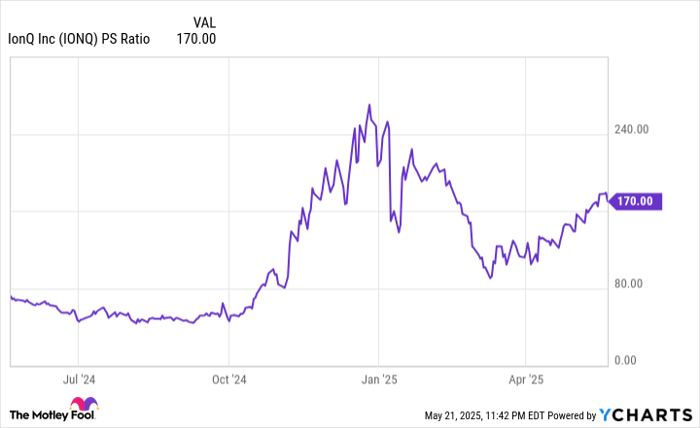

Performance of IonQ Stock

Since going public via a SPAC merger in 2021, IonQ’s stock has experienced notable fluctuations. Initial investor excitement saw the stock surge, but subsequent periods of volatility have raised questions about its long-term potential. As of October 2023, IonQ’s stock is trading at approximately $8.50, substantially down from its peak.

The company has been ramping up efforts to commercialize its quantum computing systems and expand its customer base, which includes major tech firms and research institutions. Their systems are used for solving complex problems across various industries, including finance, pharmaceuticals, and logistics, indicating that the real-world applications of quantum computing are starting to take shape.

Recent Developments

Recently, IonQ announced a partnership with Microsoft, which is set to enhance its accessibility through the Azure cloud platform. This step could be pivotal, as integrating IonQ’s systems with Azure will allow businesses to leverage quantum computing without significant upfront investments in hardware.

Additionally, IonQ continues to make strides in improving its technology. The company’s latest systems are reported to have achieved greater coherence times than previous generations, allowing for more complex calculations to be carried out without error. This advancement is crucial in validating the commercial viability of quantum computing solutions.

Market Outlook

Looking ahead, analysts are cautious yet optimistic about IonQ’s prospects. The overall market for quantum computing is expected to grow substantially, with reports suggesting it could reach $65 billion by 2030. As companies like IonQ position themselves effectively within this emerging market, their stock could potentially benefit from the growing demand for advanced computing solutions.

Conclusion

For investors considering IonQ stock, navigating the volatility of the tech market is essential. Keeping an eye on developments in quantum technology, partnerships, and customer traction will provide valuable insights into IonQ’s future. As the market for quantum computing evolves, IonQ’s ability to innovate and adapt may determine its position as a leader in this transformative field.