Introduction

Intel Corporation (NASDAQ: INTC) has long been a cornerstone in the technology sector, particularly with its dominance in the semiconductor market. As a leader in CPU technology for personal computers and servers, fluctuations in INTC stock are closely monitored by investors worldwide. Given the ongoing advancements in artificial intelligence, data centers, and 5G technology, understanding the current trends affecting INTC stock is more important than ever for potential and current investors.

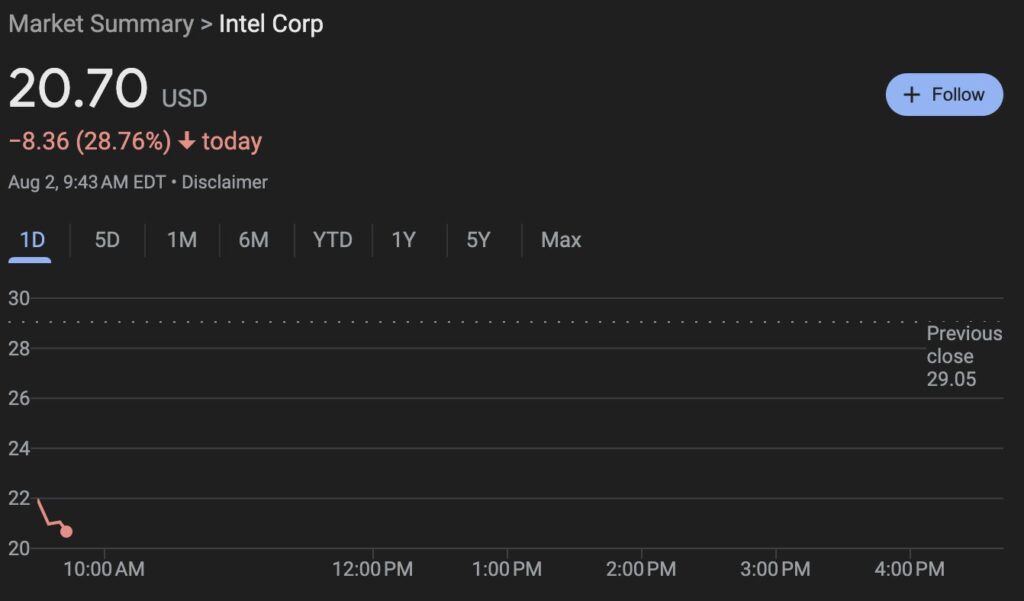

Recent Performance and Earnings Report

As of October 2023, INTC stock has been showing promising signs of recovery after facing significant downturns due to supply chain disruptions and competition from rivals like AMD and NVIDIA. In its latest earnings report released in early October, Intel reported revenues of $18.1 billion for the third quarter, surpassing analysts’ expectations. This reflects a 12% increase year-over-year, driven largely by demand for data center solutions.

However, it’s important to note EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) figures have been relatively flat, which raises questions about future growth potential. The earnings call also highlighted Intel’s investment of $20 billion into expanding manufacturing capabilities in the U.S., aiming to regain market share. Analysts predict that maintaining such investments is essential in an increasingly competitive market.

Market Response and Future Outlook

Following the earnings report, INTC stock saw an uptick in value, closing at $31.50 per share—a 6% increase in the following days. Analysts are divided on the stock’s future trajectory; some see potential for growth as Intel ramps up production capacity and pushes into new markets, while others caution that challenges from the competition could stunt its recovery. With a current market capitalization of approximately $130 billion, investors are advised to watch closely for further developments, especially regarding the rollout of Intel’s new products and technological advancements.

Conclusion

In conclusion, INTC stock presents both opportunities and risks for investors in the current market landscape. The company’s focus on expanding its manufacturing capabilities and tapping into high-demand sectors such as AI and 5G signals a strategic approach to regain lost ground. However, competition remains fierce, and investors should stay informed about these dynamics as they consider their options in the coming months. Overall, keeping an eye on INTC stock could prove beneficial for those looking to engage with the fast-evolving tech industry.