Introduction: The Importance of Inflation Monitoring

Inflation is a critical economic indicator that affects purchasing power, interest rates, and overall economic health. As Canada prepares for potential shifts in the economy, understanding inflation trends for 2025 is essential for consumers, businesses, and policymakers alike. Recent events and economic strategies suggest that inflationary pressures may continue to evolve

Current Economic Landscape

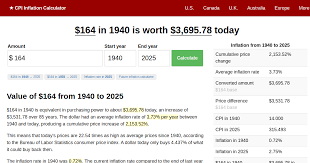

As of late 2023, Canada has experienced significant fluctuations in inflation rates. The Bank of Canada (BoC) has implemented various monetary policies aimed at curbing rising prices. The consumer price index (CPI) showed inflation cooling to approximately 2.9% in September 2023, down from a peak of over 8% in mid-2022. Analysts believe that by 2025, inflation may stabilize between 2% and 3%, close to the BoC’s target.

Factors Influencing Inflation in 2025

Multiple factors will play a role in shaping inflation in 2025. Firstly, the global supply chain disruptions caused by the COVID-19 pandemic continue to influence prices, particularly in essential goods and services. Analysts predict that as supply chains recover, inflationary pressures from this sector will ease.

Secondly, energy prices are expected to continue fluctuating due to geopolitical factors and the transition towards sustainable energy sources. The impact of climate policies may also contribute to energy costs that could affect overall inflation.

Furthermore, wage growth is another significant contributor. As the labor market tightens, higher wages could translate to increased consumer spending, inadvertently leading to higher prices.

Predictions from Economic Experts

Eminent economists from institutions like the Canadian Centre for Policy Alternatives (CCPA) and the Royal Bank of Canada (RBC) provide varying forecasts for 2025. A recent CCPA report suggests that inflation could gradually decrease to around 2%, driven by improved supply conditions. In contrast, RBC’s economists caution that ongoing labor shortages could keep inflation elevated, hovering around 3% to 3.5%.

Conclusion: The Significance of Monitoring Inflation

An understanding of the inflation landscape for 2025 is vital for Canadians as it impacts both personal financial planning and broader economic policies. Consumers may need to adjust their budgets and spending habits, while businesses should manage pricing strategies accordingly. For policymakers, accurately forecasting inflation will be crucial in determining the direction of interest rates and economic stimulus measures. As we approach 2025, remaining informed about inflation trends will help Canadians navigate the complexities of a changing economic environment.