The Importance of Inflation and Its Relevance Today

Inflation is a crucial economic indicator that affects the purchasing power of consumers and the overall health of an economy. Understanding the expected inflation trends for 2025 is vital for investors, businesses, and individuals as they plan their financial futures. Recent events, especially global economic disruptions and post-pandemic recovery strategies, have made inflation a hot topic among economists, policymakers, and the general public.

Current Trends Leading to 2025

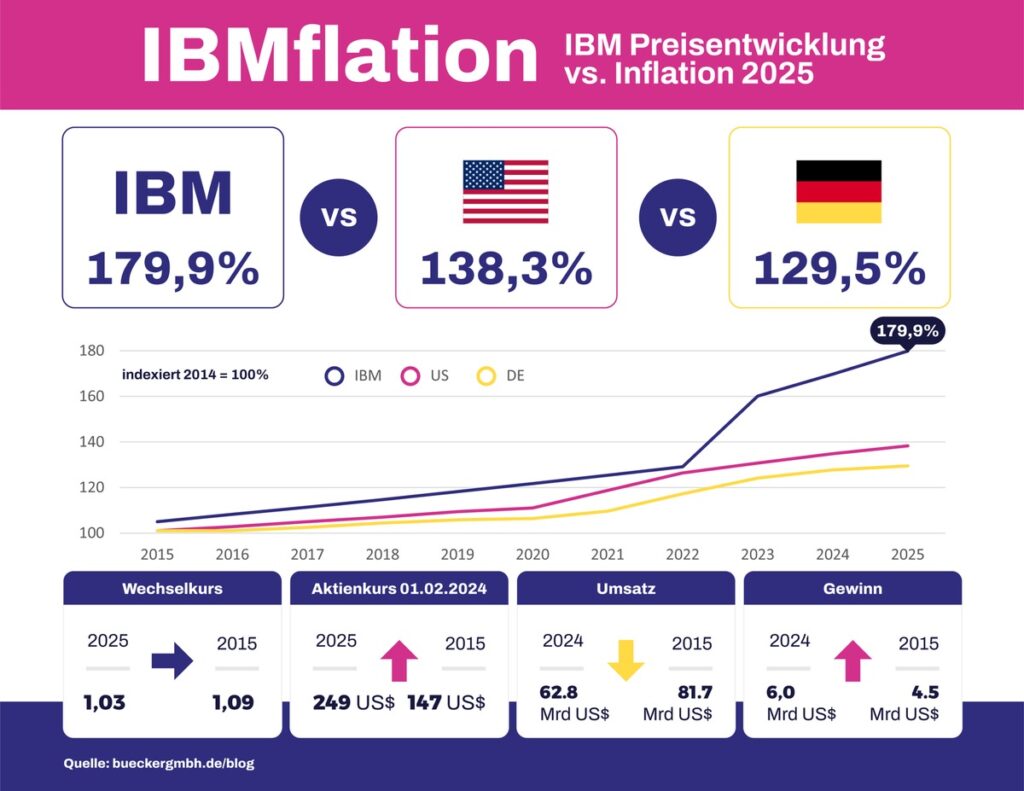

As of 2023, inflation rates in Canada and worldwide are seeing resurgence due to a combination of factors. Global supply chain disruptions, rising energy prices, and labor shortages have contributed to this inflationary environment. Over recent months, the Consumer Price Index (CPI) has indicated a steady rise, leading the Bank of Canada to implement tighter monetary policies. Projections indicate that inflation is expected to stabilize but not drop to pre-2020 levels by 2025.

According to a recent report from the Bank of Canada, inflation is expected to persist in the range of 2-3% annually through 2025, influenced heavily by ongoing geopolitical tensions and the energy crisis exacerbated by climate change policies. Economists are keeping a close eye on the upcoming fiscal policies regarding infrastructure spending and subsidies which could impact inflation rates significantly.

Potential Impacts on Consumers and Businesses

The forecasted inflation rate will have tangible impacts on consumers’ daily lives. Higher inflation means that the cost of goods and services will likely continue to rise, influencing how Canadians budget their household expenses. Essential items such as food, housing, and healthcare are projected to see above-average price hikes. For businesses, especially small to medium-sized enterprises, navigating these changes could lead to increased pricing strategies and adjustments in hiring policies to maintain profit margins.

Conclusion: Preparing for 2025

As we look ahead to 2025, both consumers and businesses must prepare for a landscape shaped by ongoing inflationary pressures. Familiarizing oneself with projected inflation rates can help mitigate financial risks. Consumers may need to re-evaluate savings and investment strategies, while businesses might have to innovate and explore new pricing models to remain competitive in a changing economic environment. The significance of understanding inflation trends cannot be overstated—it is a critical aspect of financial literacy in today’s economy.