Introduction

The GLD stock, associated with the SPDR Gold Shares ETF, represents a significant asset in the world of investments, particularly for those looking to diversify their portfolios with precious metals. As inflation concerns rise and geopolitical tensions loom, understanding GLD’s performance is crucial for investors seeking stability in uncertain times.

Current Trends in GLD Stock

Recent market analysis shows that GLD stock has experienced an upward trend due to increased demand for gold as a hedge against inflation. As of October 2023, GLD shares were trading at approximately $181.05, reflecting a robust interest from institutional investors as well as retail traders.

Market dynamics have shifted as central banks worldwide have ramped up gold purchases. The World Gold Council reported that global demand for gold reached a significant high, indicating a shift towards safer assets. This trend positively impacts GLD, often leading its valuation to rise in alignment with the price of gold.

Factors Influencing GLD Stock Performance

Several key factors drive the performance of GLD stock:

- Interest Rates: Typically, lower interest rates make gold more attractive since it doesn’t yield interest, and those rates impact investment strategies.

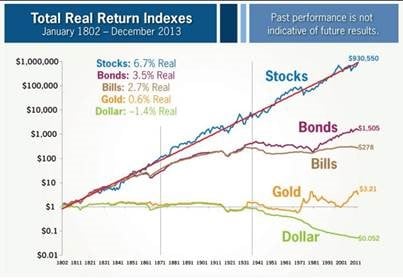

- Inflation Rates: Rising inflation often coincides with increased gold buying, as investors seek to protect purchasing power.

- Global Uncertainty: Economic and political instability can lead to a spike in gold prices, subsequently lifting GLD’s market value.

Conclusion

As the financial landscape continues to evolve, GLD stock remains a vital component of investment portfolios focused on precious metals. Analysts suggest that any significant geopolitical or economic event could further influence prices, making it a stock worth monitoring. Investors should continue to evaluate the implications of various economic indicators on GLD stock, as they could present both opportunities and risks in the near future. In conclusion, the performance of GLD stock will likely remain closely tied to broader market trends, underlining its significance as an indicator of investor confidence in gold.