The Significance of Ethereum Price

Ethereum, the second-largest cryptocurrency by market capitalization, plays a critical role in the digital economy. Following Bitcoin, its price movements significantly impact the broader cryptocurrency market. Understanding Ethereum’s price trends is essential for investors and enthusiasts alike, as they can reflect broader market sentiments and technological advancements in blockchain technology.

Current Market Overview

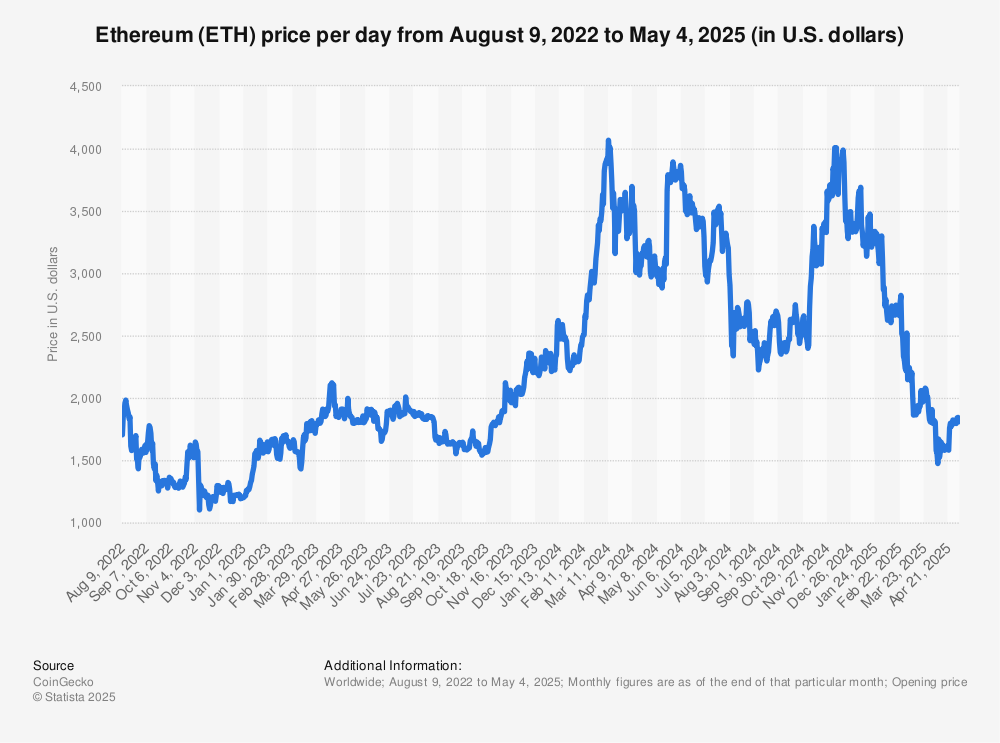

As of October 2023, Ethereum’s price is experiencing notable fluctuations, currently sitting at approximately $1,950. This marks an increase from the low of $1,700 reached earlier this year, attributed to renewed investor interest and a surge in decentralized finance (DeFi) projects. Increased participation in Ethereum’s Proof of Stake (PoS) system, which was fully implemented in 2022, has also contributed to price stabilization and growth. Major market players are beginning to revisit Ethereum after months of downturns, further injecting optimism into its price trajectory.

Events Influencing Ethereum Prices

Several factors are currently influencing Ethereum’s price. Notably, the upcoming Ethereum upgrade known as ‘Dencun’, designed to enhance scalability and efficiency, is expected to attract more developers and investors to the network. Furthermore, as traditional finance continues to integrate blockchain technology, platforms supporting Ethereum smart contracts are seeing increased usage, further supporting its price growth.

On the macroeconomic front, rising interest rates and economic uncertainty have led some investors to hedge against traditional assets by moving towards cryptocurrencies, including Ethereum. This shift, driven by younger investors seeking alternative investment options, plays a crucial role in driving demand and thus impacting Ethereum’s pricing dynamics.

Future Predictions

Analysts forecast that Ethereum’s price could reach new heights, with conservative estimates suggesting a price target of $2,500 to $3,000 by the end of 2023, driven by technological advancements and market adoption. However, increased volatility remains a concern, influenced by macroeconomic conditions and regulatory developments across the globe.

Conclusion

For readers, monitoring Ethereum’s price trends is not only about tracking numbers but understanding the underlying factors driving those changes. As Ethereum continues to evolve and develop further use cases, its price is likely to reflect those advancements. Investors should remain informed about technical developments and market conditions, as they could provide more insight into the future landscape of Ethereum and its price dynamics.