Introduction

As cryptocurrencies continue to gain traction in mainstream finance, understanding the dynamics of ETH (Ethereum) to USD (United States Dollar) conversion is essential for investors and enthusiasts alike. Ethereum, a leading blockchain platform, has seen a significant rise in value over the past decade, often challenging Bitcoin for dominance in the market. With increasing adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs), knowing how Ethereum performs against the USD is crucial for making informed investment decisions.

Current Market Overview

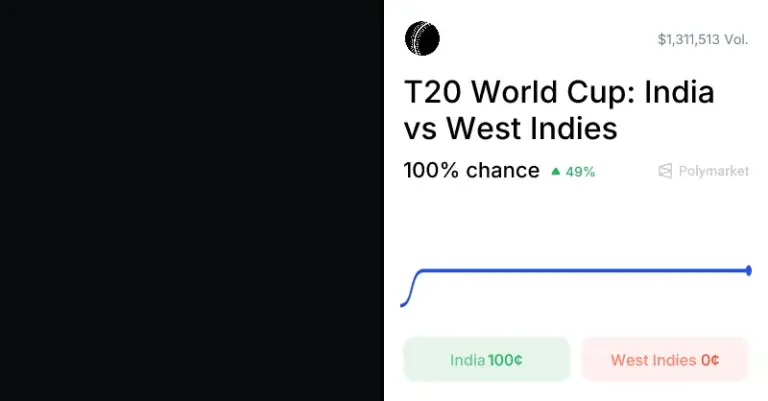

As of mid-October 2023, the conversion rate of ETH to USD has been experiencing fluctuations due to various market factors. Currently, ETH is trading around $2,250, a notable increase from the beginning of the year when it hovered around $1,800. This upward trend is attributed to several factors, including broader institutional adoption, growing interest in DeFi projects, and the ongoing innovations within the Ethereum network, particularly as it transitions to ETH 2.0, which focuses on sustainability and scalability.

However, the crypto market is notoriously volatile. Recent events such as regulatory news, macroeconomic factors, and shifts in investor sentiment can lead to rapid changes in Ethereum’s market value. For instance, news regarding potential regulatory frameworks emerging from various countries can cause sudden spikes or drops in ETH values.

Impacts of Market Trends

Supply and demand dynamics play a critical role in how ETH is valued against the USD. Recently, there has been an increase in the number of Ethereum wallets and transactions, indicating growing demand. Additionally, the Ethereum network’s transition to a proof-of-stake consensus mechanism has led to reduced inflation rates for ETH, further influencing its price positively. Analysts predict that if trends of institutional investment continue, we may observe a sustained increase in ETH prices against the dollar.

Conclusion

For investors, remaining aware of the ETH to USD conversion rate is vital for strategic financial planning. Given its recent performance, Ethereum demonstrates potential for growth, but it also harbors risks typical of the cryptocurrency market. Therefore, investors are advised to conduct thorough research, monitor market trends, and consider their risk tolerance before diving into ETH investments. As technology and regulations evolve, so will the landscape for ETH, making it a significant asset to watch in the ever-changing world of cryptocurrency.