Importance of Credit Reporting Agencies

Credit reporting agencies like Equifax are pivotal in the financial ecosystem, as they provide valuable data to lenders about borrowers’ credit histories. This data influences lending decisions and interest rates, making it essential for consumers to understand how these agencies operate.

Recent Developments at Equifax

In recent months, Equifax has come into the spotlight due to concerns over data security and privacy. Following several high-profile data breaches in previous years, the company has been working to enhance its cybersecurity measures. As of October 2023, Equifax announced a new initiative aimed at improving consumer trust by offering free identity theft protection services. This response aligns with growing public concern about data privacy and security.

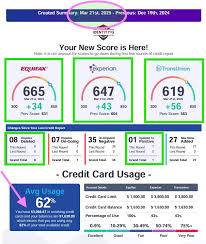

Equifax’s Impact on Consumers

Equifax, one of the largest credit bureaus in Canada, plays a crucial role in determining credit scores used by lenders. Consumers are directly affected by the information that appears in their credit reports, which can impact their ability to secure loans or mortgages. According to recent statistics, approximately 30% of Canadians have been denied credit based on errors in their credit reports. This underscores the importance of monitoring one’s credit report regularly, a service Equifax provides through its online platform.

Conclusion: The Future of Credit Reporting

As we move forward, the significance of Equifax and similar agencies in the financial sector remains ever-present. With increasing awareness about creditworthiness and stringent lending practices, understanding how credit reports influence financial decisions is critical for consumers. Furthermore, enhanced data protection measures are anticipated to be a key focus for Equifax as it navigates the evolving landscape of credit reporting. Consumers are encouraged to stay informed about their credit status and take proactive steps to protect their financial health.