Introduction

Enbridge Inc., a leading North American energy infrastructure company, has been in the financial spotlight recently due to its stock performance and the fluctuations in the energy sector. With the increasing focus on sustainability and clean energy, understanding the trajectory of Enbridge stock is essential for investors looking to navigate the contemporary energy landscape. This article discusses the current happenings concerning Enbridge stock and what they mean for potential investors.

Recent Market Performance

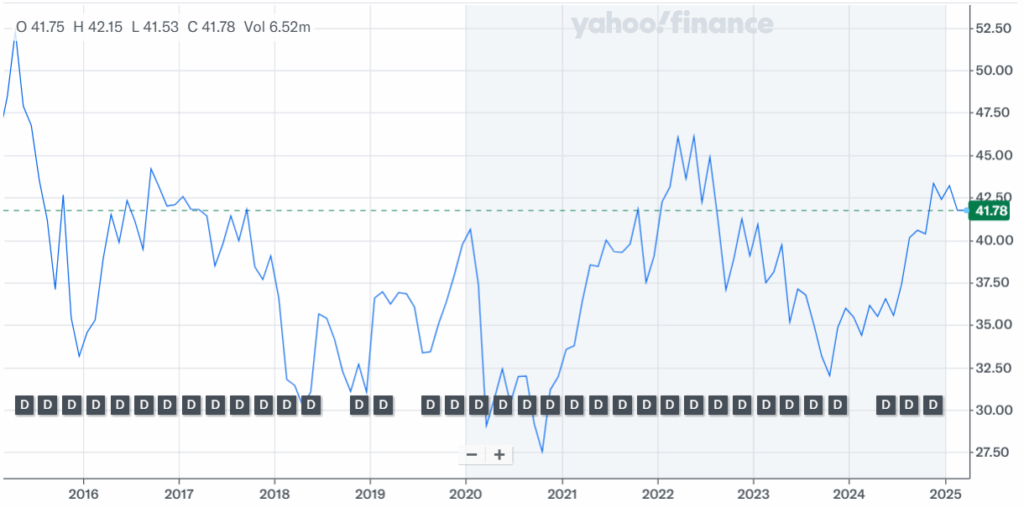

As of late October 2023, Enbridge’s stock has seen significant movement in light of various geopolitical and economic factors. The company’s shares traded at approximately CAD 54, reflecting a moderate increase of around 3% over the past month. Analysts attribute this rise to ongoing demand for natural gas and crude oil, combined with the company’s commitment to reducing its carbon footprint through investments in clean energy projects.

In the third quarter of 2023, Enbridge reported an increase in earnings by 10% compared to the same quarter last year, largely driven by strong performance in its pipeline and utility segments. The company has also emphasized its focus on sustainable investments, with plans to allocate over CAD 2 billion annually towards renewable energy sources.

Investor Sentiment and Future Insights

Investor sentiment surrounding Enbridge stock remains cautiously optimistic. Despite recent volatility in the energy sector attributed to fluctuating oil prices and market uncertainties, Enbridge aims to maintain steady dividends, offering an attractive return for long-term stakeholders. As of now, Enbridge has maintained its dividend payout ratio, which is particularly appealing for income-focused investors.

Moreover, analysts from major financial institutions have varied predictions for Enbridge stock, with price targets ranging from CAD 50 to CAD 60. This range reflects the market’s mixed sentiment on the energy sector’s transition dynamics. The move towards renewable energy and government regulations could either pose risks or provide opportunities for growth, making it crucial for investors to monitor these developments closely.

Conclusion

Enbridge stock presents an intriguing investment opportunity for both seasoned investors and newcomers to the market. With a solid track record, commitment to sustainability, and robust earnings reports, Enbridge continues to position itself as a leader in the energy infrastructure space. However, potential investors should remain vigilant and take into account the uncertainties surrounding the energy market. As the global energy landscape continues to evolve, Enbridge’s strategic initiatives could be pivotal in determining its stock performance in the coming quarters.