Introduction

Duolingo, the popular language-learning platform, recently drew attention from investors with fluctuations in its stock price. As a public company traded on the Nasdaq under the ticker symbol “DUOL”, Duolingo’s financial performance and market position are crucial to understanding its relevance in the tech and education sectors. This article will explore the recent trends in Duolingo stock, factors influencing its valuation, and what this means for current and prospective investors.

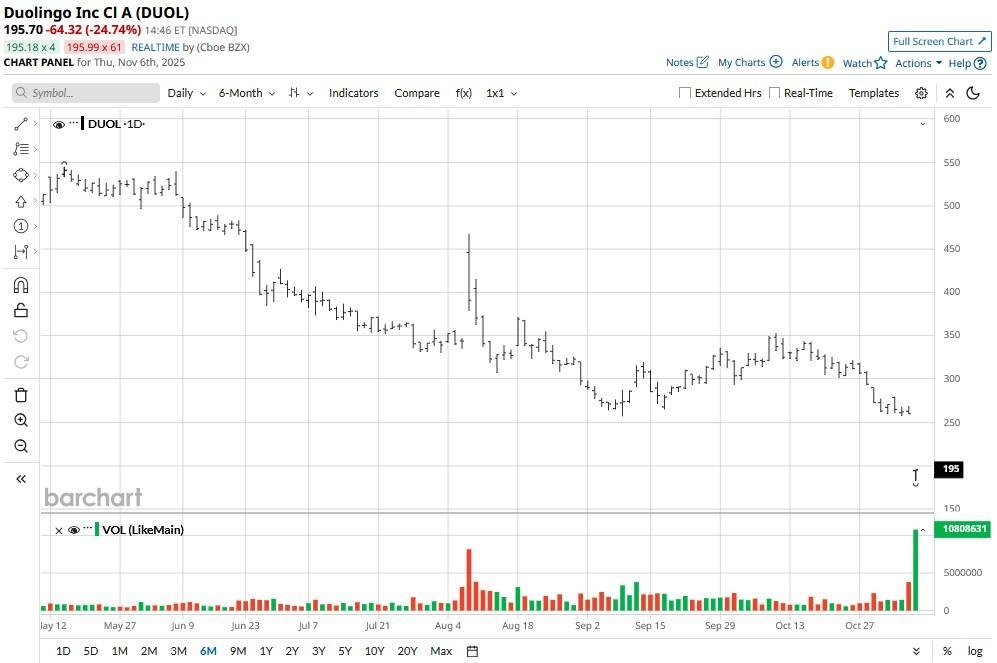

Recent Market Performance

As of late October 2023, Duolingo stock has been subject to volatility, reflecting broader trends in the tech sector. After a significant rally earlier in the year, the stock experienced a pullback as investors reassessed growth prospects. Data from Yahoo Finance indicates that Duolingo saw fluctuations averaging between $95 and $120 in the past few months. Analysts attribute this volatility to various factors including heightened competition in the language learning market and global economic uncertainties that affect consumer spending.

Key Factors Affecting Duolingo Stock

- Growth in User Base: Despite recent stock fluctuations, Duolingo continues to grow its user base, recently surpassing 50 million monthly active users. This growth warrants continued attention from investors, albeit tempered by potential challenges.

- Financial Performance: Duolingo reported a significant increase in revenue in its latest earnings report, yet expenses related to marketing and R&D have also increased, prompting some concern about profit margins.

- Competition: The rise of new language learning apps and platforms poses challenges to Duolingo’s market share. Competitors such as Rosetta Stone and Babbel are increasingly adopting innovative digital strategies.

- Overall Market Conditions: The broader stock market environment also plays a critical role; uncertainties and fluctuations in technology stocks generally have a ripple effect.

Conclusion

In summary, the performance of Duolingo stock remains a point of interest for both investors and industry analysts. With its strong user engagement and adaptability within the digital education sector, Duolingo has solidified itself as a key player. However, the inherent volatility influenced by competition and market conditions suggests investors should remain cautious. As Duolingo explores new revenue streams such as subscriptions and partnerships, the company’s ability to maintain user interest and adapt to competitive pressures will significantly impact its stock value moving forward. Therefore, keeping an eye on Duolingo’s quarterly earnings reports and strategic initiatives will be essential for those looking to invest in or evaluate the company’s market potential.