Introduction

Mortgage rates are a critical factor in the housing market, influencing how much Canadians pay for their homes. With central banks adjusting interest rates in response to inflation and economic conditions, mortgage rates have fluctuated significantly over the past year. Understanding these trends is essential for potential homebuyers and current homeowners looking to refinance.

Current Mortgage Rates

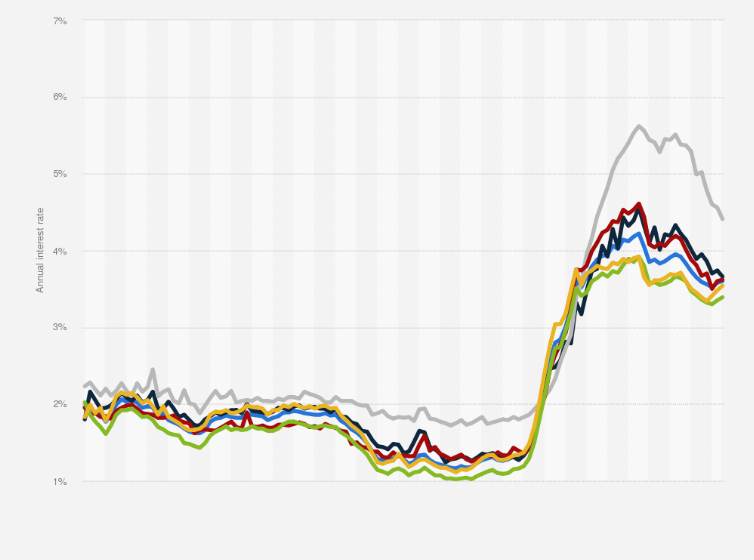

As of October 2023, mortgage rates in Canada have seen a steady increase from the previous year. The Bank of Canada raised its benchmark interest rate to curb inflation, resulting in average fixed mortgage rates now exceeding 5% for the first time since 2008. Variable mortgage rates, which fluctuate with the central bank’s rate, are also feeling the impact, averaging about 4.5%.

Impact on Homebuyers and Market Trends

The rise in mortgage rates has considerably impacted the housing market. Many prospective homebuyers are experiencing affordability challenges, leading to a slowdown in home sales across major Canadian cities like Toronto and Vancouver. According to the Canadian Real Estate Association (CREA), home sales fell by over 10% year-over-year in September, with many buyers opting to delay their purchases in anticipation of a potential decrease in rates or seeking less expensive properties.

Additionally, the rental market has seen increased pressure as potential buyers remain on the sidelines. Statistics Canada reports that rental prices have increased by 12% in urban areas due to rising demand and insufficient housing supply.

The Future of Mortgage Rates

Looking ahead, experts predict that rates may stabilize in early 2024, depending on the effectiveness of monetary policy in controlling inflation. However, the Canadian economy remains unpredictable, and potential shifts in global markets could further influence mortgage rates.

Conclusion

As the landscape of mortgage rates continues to evolve, it’s vital for Canadians to stay informed and consider their financial situations carefully. Whether entering the housing market or refinancing, understanding market trends can significantly impact long-term financial health. Keeping an eye on interest rates and consulting with financial advisors can provide clarity in these uncertain times.