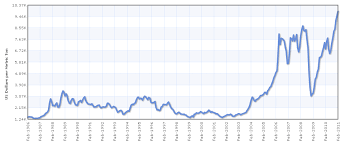

The Importance of Copper Prices

The price of copper is a key indicator of economic health and activity globally. It plays a crucial role in various industries, from construction to electronics, and its fluctuations can reflect broader economic trends. For Canada, which is one of the world’s largest producers of copper, understanding these price movements is essential for both the economy and individual investors.

Current Trends in Copper Prices

As of October 2023, copper prices have shown significant volatility. Recent data indicates that prices have increased by approximately 20% over the past year, influenced by a surge in demand from the renewable energy sector and ongoing supply chain constraints. The London Metal Exchange reported prices around $4.50 per pound, driven by robust industrial activity in countries like China and accelerated investments in green technology.

Global Supply and Demand Factors

The rise in copper prices is attributed to several global factors. The demand for copper is increasing as nations push for renewable energy solutions, especially electric vehicles and solar panels, both of which require substantial copper wiring and components. Furthermore, supply chain disruptions from key copper-producing nations, including Chile and Peru, have led to reduced output. Political unrest, labor strikes, and environmental regulations continue to impact mining operations and output levels, creating further constraints on copper supply.

Implications for Canada

For Canada, high copper prices present both opportunities and challenges. Several Canadian mining companies are poised to benefit from the rising price, which can lead to increased investment in mining operations, job creation, and economic growth. However, these price increases could also lead to inflationary pressures and affect industries dependent on copper for manufacturing and construction, possibly leading to higher prices for consumers.

Conclusion and Future Outlook

In summary, the current trends in copper prices are shaped by robust demand in the renewable energy sector, global supply constraints, and fluctuating economic conditions. As we look forward, market analysts predict that copper prices will continue to face upward pressure due to ongoing advancements in green technology and infrastructure spending. Investors and industry stakeholders should closely monitor these developments to adapt to potential price changes that could impact the economy.