Introduction

The stock market continuously evolves, and investors must keep an eye on trending stocks to make informed decisions. One stock gaining attention is CRWV, which is attracting traders due to its market performance and growth potential. With the ongoing fluctuations in the economy, understanding CRWV stock is crucial for current and prospective investors looking to navigate the market effectively.

Current Market Performance

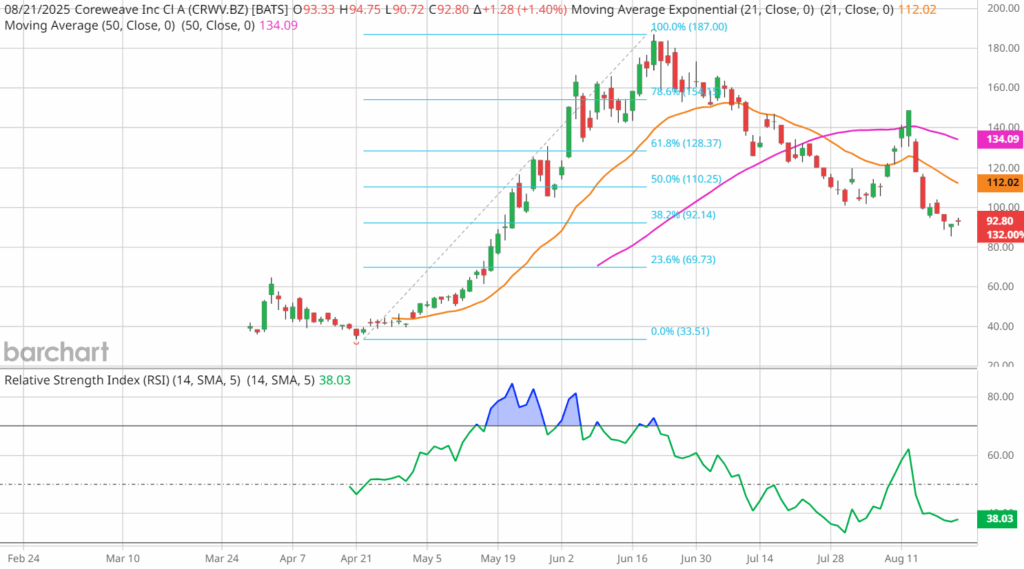

As of October 2023, CRWV stock has shown significant volatility yet promising growth in recent weeks. The stock opened at $5.30 and witnessed a steady increase, peaking at approximately $7.20 earlier this month. Analysts attribute this rise to the company’s recent announcements regarding innovative product launches aligned with market demands, especially in the tech sector.

Investor sentiment surrounding CRWV stock has been bolstered by positive earnings reports and strategic partnerships that open new revenue streams. Additionally, technological advancements in their offerings have allowed the company to expand its market share rapidly. Recent reports indicate a 12% increase in revenue compared to the previous quarter, sparking interest among analysts and investors alike.

Key Developments Influencing CRWV Stock

Several key developments have influenced the fluctuations in CRWV stock over the past few months:

- Product Innovation: The introduction of new features in their flagship products has attracted attention from industry leaders.

- Market Expansion: Recent expansion into international markets is expected to drive revenues up in the coming quarters.

- Stock Buybacks: Management announced a share buyback program aimed at strengthening shareholder value, which often reassures investors.

Future Forecasts

Looking ahead, the consensus among market analysts suggests that CRWV stock may continue its upward trend. Analysts are projecting a target price of approximately $10 by the end of 2024, contingent on sustained revenue growth and continuous product innovation. However, potential risks such as market competition and regulatory changes remain factors to monitor closely.

Conclusion

In conclusion, CRWV stock presents an intriguing opportunity for investors seeking growth within the tech sector. With impressive recent performance and notable strategic initiatives in place, many foresee a promising future. As always, potential investors should conduct thorough research and consult financial advisors to tailor investments according to their risk tolerance and investment goals. Keeping abreast of ongoing developments will remain essential for those looking to capitalize on CRWV stock’s potential.