Introduction

CRCL stock, representing the shares of Crucible Acquisition Corporation, has recently garnered attention from investors and market analysts alike. As a blank-check company, CRCL is focused on merging with or acquiring companies within the technology and renewable resource sectors. The performance and strategic direction of CRCL stock are highly significant given the growing interest in sustainable investments and the technology industry’s rapid advancements.

Recent Performance and Market Trends

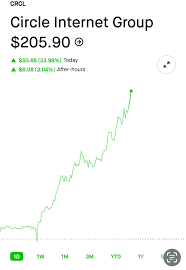

Over the past few months, CRCL stock has seen fluctuations that reflect broader market sentiments regarding SPACs (Special Purpose Acquisition Companies). As of mid-October 2023, CRCL shares have risen approximately 15% since the beginning of the month, following a series of positive announcements regarding potential merger candidates. Analysts project that if a target company is successfully acquired—especially one aligned with green technology or innovative startups—CRCL stock could see even more significant gains.

The past quarter has shown CRCL’s commitment to transparency and investor engagement, hosting webinars and publishing detailed projections of their intended business strategies. According to investment research from MarketWatch, CRCL’s sector-specific focus has piqued interest among growth-oriented investors looking to capitalize on trends in renewable energy and transformative technologies.

Industry Insights

The tech sector’s rebound after a challenging period earlier this year has also contributed to the stock’s uptick. Notably, the renewable energy sector is experiencing substantial growth, stimulated by rising global ESG (Environmental, Social, and Governance) criteria in investment strategies. Crucible Acquisition Corporation’s potential partnerships within this space align perfectly with these trends, making CRCL stock a focus point for investors who prioritize sustainability.

Conclusion and Future Outlook

Looking forward, analysts suggest that CRCL’s potential acquisition announcements will be pivotal for its stock performance. The upcoming months could bring high volatility as investors react to news surrounding merger developments and financial projections. For those considering investing in CRCL stock, it’s crucial to keep an eye on market trends and key announcements from the company. With a targeted approach and effective negotiations, CRCL has the potential to become a leading player in the booming sectors of technology and renewable energy, making its stock an intriguing option for investors seeking growth opportunities.