Introduction

Coinbase Global Inc., founded in 2012, has emerged as a leading platform for cryptocurrency exchanges, significantly influencing the digital asset landscape. Its stock, listed on the Nasdaq under the ticker symbol COIN, has become a focal point for investors as the crypto market fluctuates. Understanding Coinbase stock is vital for those interested in cryptocurrencies and the tech financial sector, especially in light of recent regulatory developments and market volatility.

Recent Performance Trends

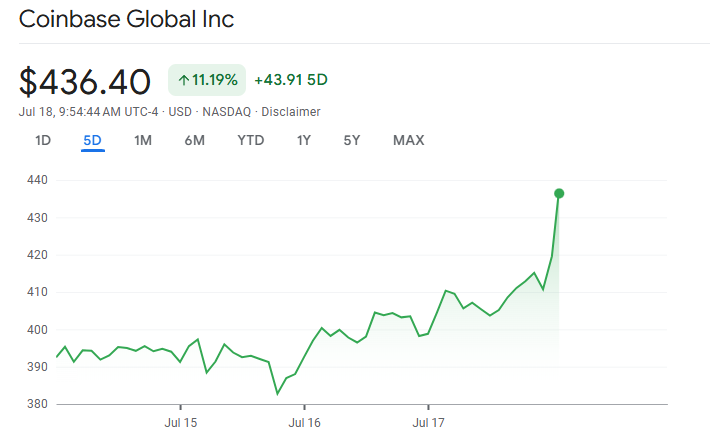

As of October 2023, Coinbase’s stock has displayed both resilience and volatility, reflecting the broader cryptocurrency market trends. Since its direct listing in April 2021, COIN stock initially surged to around $429 per share but has experienced sharp declines, hitting lows close to $31 earlier in 2023. However, it has recently seen a rebound, consistently trading in the $80-$100 range, influenced by various factors including increased adoption of cryptocurrency, institutional interest, and quarterly earnings reports.

The company’s Q2 2023 earnings report showcased a net revenue of $890 million, demonstrating a significant 30% year-over-year increase, largely attributed to an uptick in trading volume as Bitcoin prices surged. Despite this growth, the firm continues to face challenges stemming from regulatory scrutiny, with the SEC’s ongoing investigations into its operations and asset classifications, which could impact its financial future.

Market Influences and Future Outlook

Coinbase’s stock is deeply intertwined with the dynamics of the cryptocurrency market and regulatory landscape. Recent positive developments, such as potential cryptocurrency-friendly legislation in the United States, have contributed to a favorable environment for Coinbase’s operations. Analysts remain cautiously optimistic, projecting that if Bitcoin and other major cryptocurrencies maintain their upward trajectories, COIN stock could see further appreciation.

However, uncertainties regarding regulatory frameworks pose risks that investors need to consider. The ongoing investigations by the SEC could lead to operational adjustments that might affect Coinbase’s earnings potential. Market analysts recommend keeping a close watch on both short-term price movements and longer-term strategic initiatives that the company may embark upon.

Conclusion

Coinbase stock represents an intriguing investment opportunity amidst a rapidly evolving digital landscape. With its strong performance in Q2 2023 providing a glimmer of hope for investors, potential investors should remain vigilant regarding regulatory developments and market trends. As the cryptocurrency market continues to mature, Coinbase’s ability to navigate these challenges will be crucial for its future success and stock price stability.