Introduction

The stock of Astound Group (ASTS) has gained significant attention among investors and analysts in recent weeks. As one of the key players in the communication and broadband services sector, understanding ASTS stock is crucial for making informed investment decisions. Its recent market activities and growth potential present both opportunities and challenges for shareholders.

Recent Performance

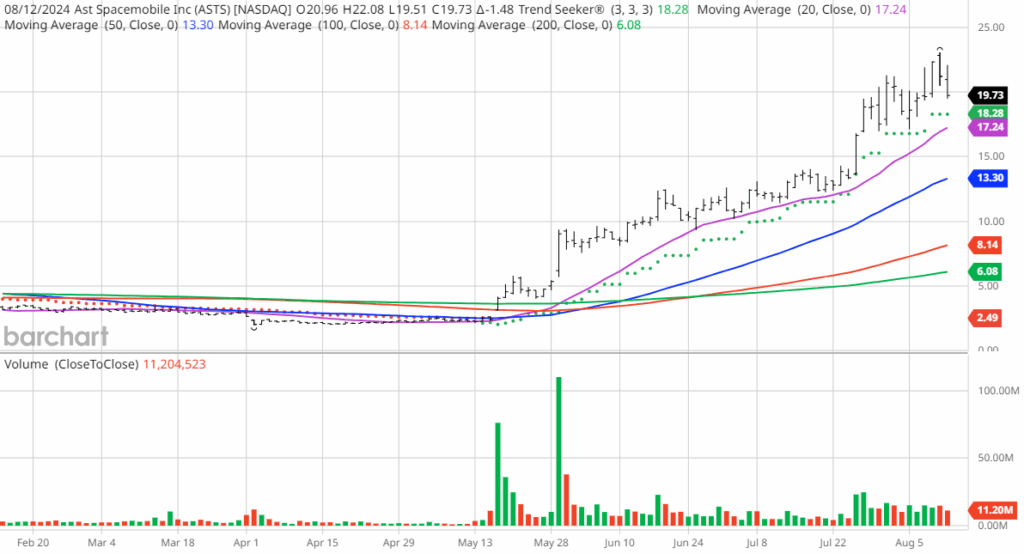

As of October 2023, ASTS stock has seen substantial fluctuations. After reaching a peak of approximately $10.25 earlier in the month, it has retreated to around $7.50 as of the last trading session. Analysts suggest that the recent decline can be attributed to broader market trends affecting technology and communication sectors, coupled with investor caution amid rising interest rates.

Market Trends and Analysis

Astound Group has reported strong quarterly earnings, which have contributed to some optimistic forecasts. The company announced a 15% increase in revenue compared to the same quarter last year, driven by more subscribers due to the uptick in demand for reliable internet services. Additionally, Astound’s ongoing investments in infrastructure are expected to enhance its service offerings, potentially attracting new users and boosting long-term growth.

Analysts from several reputable firms have mixed views on ASTS stock. Some believe that potential regulatory changes in the telecom industry may create a favorable environment for companies like Astound, while others caution that competitive pressures may limit profitability. Investors are advised to monitor these developments closely.

Investor Sentiment

Investor sentiment surrounding ASTS remains divided. Positive momentum continues to be backed by favorable earnings reports and market demand; however, external economic factors create uncertainty. With the upcoming earnings report scheduled for mid-November, many traders are positioning themselves in anticipation of new data that could influence stock performance.

Conclusion

In summary, ASTS stock presents a compelling case for both cautious investors and those looking for growth opportunities in the telecom sector. While recent volatility reflects market challenges, the underlying fundamentals of the company and its strategic initiatives signal potential for recovery and growth. Stakeholders should remain vigilant and consider both the historical performance and future prospects of ASTS when making investment decisions. As the market continues to evolve, informed analysis will be crucial in navigating the complexities of ASTS stock.