Introduction

The landscape of the stock market has seen significant events over the past few years, particularly with the rise of meme stocks like AMC Entertainment Holdings (AMC). Initially known for its popularity during the pandemic as a movie theater chain, AMC has transformed into a symbol of retail investor power. This article explores the recent trends surrounding AMC stock, its current valuation, and what the future may hold for investors.

Current Market Trends

In 2023, AMC stock has experienced a volatile journey, reflecting broader market uncertainties and shifts in investor sentiment. Following the height of its trading frenzy in 2021, where shares skyrocketed due to retail investor enthusiasm, the stock has witnessed significant fluctuations. As of mid-October 2023, AMC shares are trading around $30, with a 52-week range between $5 and $45.

The volatility in AMC stock can be attributed to various factors, including the performance of the film industry, the company’s financial recovery post-pandemic, and activist investors’ strategies. AMC’s quarterly earnings reports have shown gradual improvement, with higher revenues as audiences return to theaters; however, concerns about rising operational costs and competition from streaming services persist.

Institutional Interest and Retail Trading

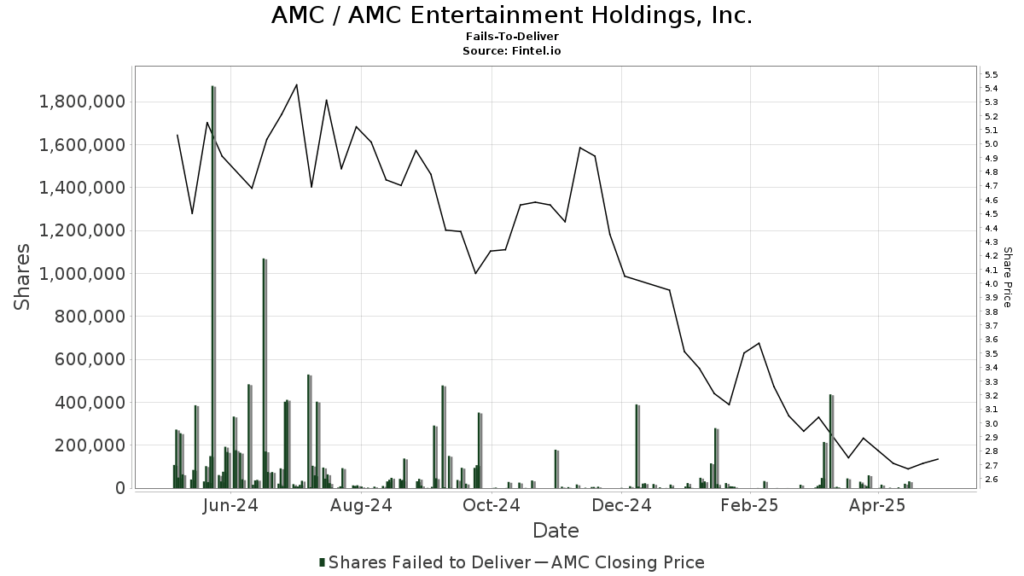

Institutional interest in AMC has fluctuated, with some hedge funds increasing their stakes while others have chosen to bet against the stock through short selling. According to data from S3 Partners, short interest in AMC has remained high, with approximately 20% of the company’s float currently shorted. This dynamic has kept the stock in the spotlight, sparking conversations among retail investors who have organized through social media platforms to advocate for holding their shares.

Future Predictions

Looking ahead, analysts remain divided on AMC’s future performance. Some predict the stock could climb higher as Hollywood continues to recover, coupled with potential expansions into new revenue streams, such as on-demand viewing options and partnerships with streaming services. Others, however, express caution, attributing concerns to the overall sustainability of its stock price and ongoing market volatility.

Conclusion

The phenomenon surrounding AMC stock illustrates the evolving nature of investments in the digital age, where retail traders can significantly influence market dynamics. For investors considering AMC, it’s essential to stay informed and weigh the risks against potential rewards. As the landscape of the entertainment industry continues to shift, AMC’s ability to adapt and capture audience interest will be crucial in determining its stock performance moving forward.